GBP/JPY rebounds towards 182.60 as Pound Sterling recovers head of Tokyo CPI

- The GBP/JPY has recovered once again into the midrange, near the 200-hour SMA.

- Japan's Tokyo CPI inflation reading due in the early Friday Asia market session.

- The Guppy continues to push into consolidation ranges as the flounders.

The GBP/JPY is bouncing back from a near-term low of 181.13 set in early Thursday trading, and the Guppy is now pushing back safely into the midrange of consolidation that has plagued the pair since the Yen (JPY) skidded to a multi-year low of 186.00 against the Pound Sterling (GBP) back in August.

The chronically discounted JPY has been floundering on the floorboards for the entire back half of 2023, drumrolling against the 182.00 handle on a regular basis since the GBP/JPY first rose to the level in mid-June.

Yen traders will now be looking towards Japan's Tokyo Consumer Price Index (CPI) inflation reading due in the early Asia market session for Friday.

Tokyo CPI inflation is expected to hold steady at previous figures, with the Tokyo CPI Core reading for October forecast to print at 2.5%, in-line with the figure given in September.

A miss for Tokyo CPI could see the JPY face another bout of firm selling pressure despite the Bank of Japan's (BoJ) recent threats to defend the Yen's rates in FX markets. With the BoJ's negative rate regime leaving the rate differential between the JPY and all other currencies increasingly widening as global central banks rase rates to combat inflation, the JPY has very little choice but to keep declining.

A miss for CPI inflation would mean the BoJ is likely to keep waffling on ending their negative rate regime with the central bank petrified of Japanese inflation slumping below their 2% target.

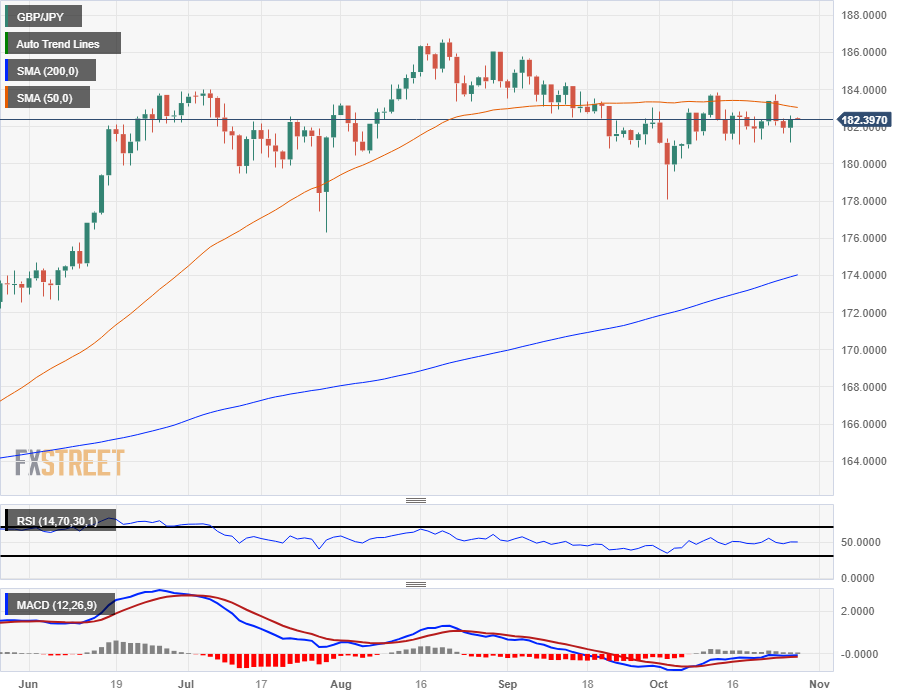

GBP/JPY Technical Outlook

The GBP/JPY continues to remain pinned close to the 50-day Simple Moving Average (SMA) as the pair drifts into the midrange with momentum completely drained out of the charts.

The 200-day SMA is slowly closing the distance on price action as the Guppy drifts sideways between 180.00 and 184.00, and the long-term moving average is pushing upwards into 174.00.

The last meaningful high sits at 186.77, a level that many investors are unlikely to gather the courage to break past as markets weigh the chances of a full-scale market intervention to protect the JPY.

In the meantime, the GBP/JPY is up nearly 18% from 2023's lows that were set near 155.35 back in January.

GBP/JPY Daily Chart

GBP/JPY Technical Levels