Canadian Dollar catches a bid despite Crude Oil drop, BoC's Macklem tows the line

- Canadian Dollar flows try to stage a rebound after last week’s declines.

- Bank of Canada Governor Tiff Macklem holds steady, reiterates policy stance.

- Weaker bids on Crude Oil limits CAD upside.

The Canadian Dollar (CAD) is hunting for some green territory against the US Dollar USD to kick off the new trading week. The Loonie’s topside remains limited as Crude Oil prices fall back, limiting momentum in the Oil-dependent CAD.

Bank of Canada (BoC) Governor Tiff Macklem will testify before the Canadian federal government’s Standing Senate Committee on Finance later today. The BoC head is expected to land hawkish, while also awaiting “clear evidence” that inflation in Canada will return to the BoC’s target level of 2%.

Daily Digest Market Movers: Canadian Dollar attempts to stage Monday recovery

- The CAD is trying to claw back chart paper after dipping into a new eight-month low last week.

- BoC’s Governor Macklem tesified before the federal financial oversight committee today.

- Round 2 of Governor Macklem’s testimony is slated for Wednesday.

- Despite weakening economic data, inflation risks remain elevated for Canada.

- Macklem reiterates that the BoC does not see a recession coming, despite the path to a soft landing having narrowed recently.

- Crude Oil prices look soft for Monday as geopolitical tensions from the Gaza Strip conflict remain contained in the region.

- WTI Crude Oil bids are down around 3% for the day.

- Weakening barrel bids are limiting CAD upside.

- Loonie traders will want to keep an eye out for Canadian Gross Domestic Product (GDP) figures on Tuesday.

- Bank of Canada’s Macklem: If inflationary pressures persist, we are prepared to raise rates further

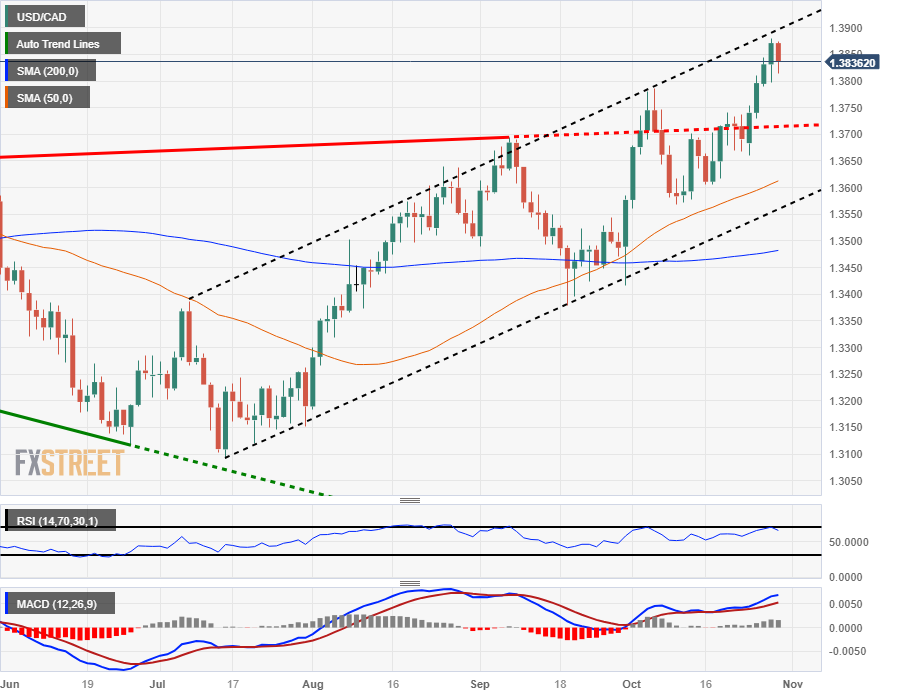

Technical Analysis: Canadian Dollar trying to extend a rebound over 1.2850 against the US Dollar

The Canadian Dollar (CAD) is catching a relief bid from last Friday’s eight-month low against the US Dollar (USD), sending the USD/CAD pair back below 1.3850 after tapping 1.3880 late last week.

An extended recovery in the Loonie from here will see 1.3850 firming up into a significant technical resistance level moving forward. On the top side, a bullish break will see the USD/CAD set to challenge 2022’s high of 1.3978 set over one year ago, back in mid-October of last year.

In the meantime, a downside continuation will run into technical support from the 50-day Simple Moving Average (SMA), which is currently lifting north of the 1.3600 handle, with the last swing low pricing in an interim floor from 1.3569.

Long-term support sits at the 200-day SMA currently parked just below 1.3500.

USD/CAD Daily Chart

Canadian Dollar FAQs

What key factors drive the Canadian Dollar?

The key factors driving the Canadian Dollar (CAD) are the level of interest rates set by the Bank of Canada (BoC), the price of Oil, Canada’s largest export, the health of its economy, inflation and the Trade Balance, which is the difference between the value of Canada’s exports versus its imports. Other factors include market sentiment – whether investors are taking on more risky assets (risk-on) or seeking safe-havens (risk-off) – with risk-on being CAD-positive. As its largest trading partner, the health of the US economy is also a key factor influencing the Canadian Dollar.

How do the decisions of the Bank of Canada impact the Canadian Dollar?

The Bank of Canada (BoC) has a significant influence on the Canadian Dollar by setting the level of interest rates that banks can lend to one another. This influences the level of interest rates for everyone. The main goal of the BoC is to maintain inflation at 1-3% by adjusting interest rates up or down. Relatively higher interest rates tend to be positive for the CAD. The Bank of Canada can also use quantitative easing and tightening to influence credit conditions, with the former CAD-negative and the latter CAD-positive.

How does the price of Oil impact the Canadian Dollar?

The price of Oil is a key factor impacting the value of the Canadian Dollar. Petroleum is Canada’s biggest export, so Oil price tends to have an immediate impact on the CAD value. Generally, if Oil price rises CAD also goes up, as aggregate demand for the currency increases. The opposite is the case if the price of Oil falls. Higher Oil prices also tend to result in a greater likelihood of a positive Trade Balance, which is also supportive of the CAD.

How does inflation data impact the value of the Canadian Dollar?

While inflation had always traditionally been thought of as a negative factor for a currency since it lowers the value of money, the opposite has actually been the case in modern times with the relaxation of cross-border capital controls. Higher inflation tends to lead central banks to put up interest rates which attracts more capital inflows from global investors seeking a lucrative place to keep their money. This increases demand for the local currency, which in Canada’s case is the Canadian Dollar.

How does economic data influence the value of the Canadian Dollar?

Macroeconomic data releases gauge the health of the economy and can have an impact on the Canadian Dollar. Indicators such as GDP, Manufacturing and Services PMIs, employment, and consumer sentiment surveys can all influence the direction of the CAD. A strong economy is good for the Canadian Dollar. Not only does it attract more foreign investment but it may encourage the Bank of Canada to put up interest rates, leading to a stronger currency. If economic data is weak, however, the CAD is likely to fall.