AUD/NZD Price Forecast: Aussie sees early Wednesday break higher against Kiwi

- The AUD/NZD spent most of Tuesday drifting lower before a late-day break buoyed the pair.

- The Aussie is trading into familiar top end against the Kiwi heading into Wednesday's market session.

- The Kiwi stumbled on an employment data miss, hobbling the NZD's chances to turn bullish.

The AUD/NZD has bumped back over 1.0900 after the Kiwi (NZD) tripped and stumbled in early Wednesday market action, trading back down against the Aussie (AUD) and sending the AUD/NZD tipping back into a near-term high around 1.0930.

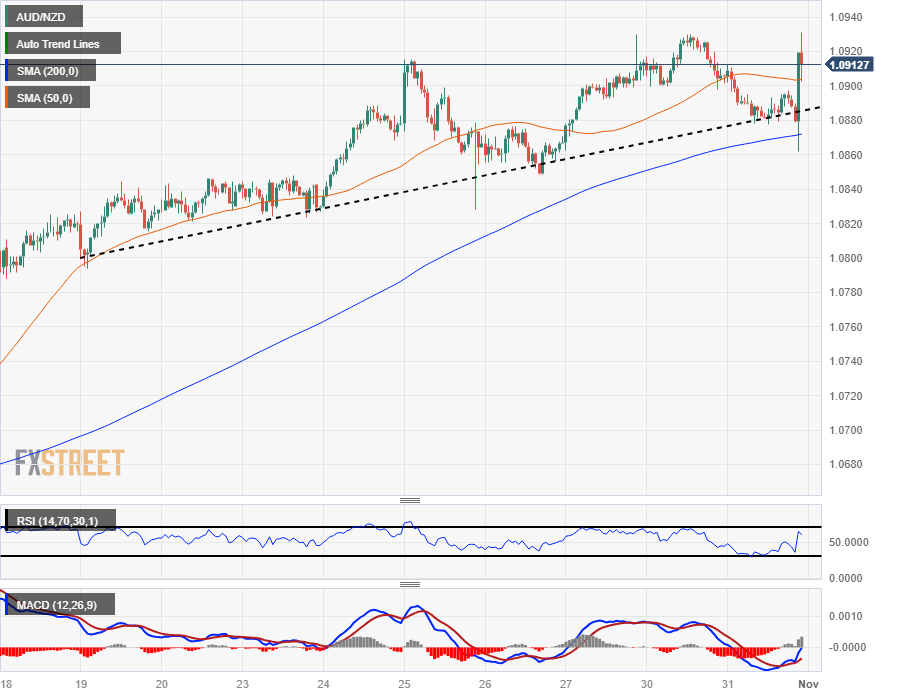

Aussie intraday declines sent the AUD/NZD back into the 200-hour Simple Moving Average (SMA) before the pair caught a rebound bid from the moving average.

The pair is trading back into the high end of recent action, but further upside remains limited for the AUD with long-term resistance piling up from the 1.0920 level.

On the down side, prices have been firmly cycling the 200-day SMA for most of the back half of 2023, and it won't take much to push the Aussie back into a bearish pattern in a return to the long-run average.

Technical indicators are also running dry on the high side, with the Relative Strength Index (RSI) and Moving Average Convergence-Divergence (MACD) both tipping into overbought territory, though daily candlestick traders will want to wait for a slow-MA MACD crossover to confirm bearish momentum.

AUD/NZD Hourly Chart

AUD/NZD Daily Chart

AUD/NZD Technical Levels