EUR/GBP struggling to hold onto 0.8700 despite rebound from Wednesday lows

- The EUR/GBP is trading back up from the day's bottom, but struggling to maintain momentum.

- Euro weakening after data softened further on Tuesday, EU GDP missed market calls.

- The BoE is slated for Thursday, expected to hold despite sticky inflation.

The EUR/GBP is trading close to the 0.8700 handle after seeing a halting rebound from the day's lows near 0.8685.

The Euro got knocked back in Tuesday trading after European Gross Domestic Product (GDP) figures missed the mark, alongside pan-EU inflation figures also flubbed forecasts.

European GDP came in at -0.1% for the 3rd quarter compared to the 2nd quarter's 0.1% increase, and declined past the broader market's expected flat reading of 0.0%.

EU Harmonized Index of Consumer Prices (HICP) also missed the mark, printing at 2.9% for the year into October compared to the forecast 3.1%, well below the previous period's 4.3%. The data misses are highlighting investor concerns of a steepening economic downturn across the European continent.

Market to punish GBP on impression that BoE is not doing enough to fight price risks – Commerzbank

European markets are now turning to the Bank of England's (BoE) upcoming rate call for Thursday. The BoE is broadly expected to hold rates steady once more, and investors are becoming leery of the UK central bank's "wait-and-see" approach as inflation continues to prove much stickier than most expected.

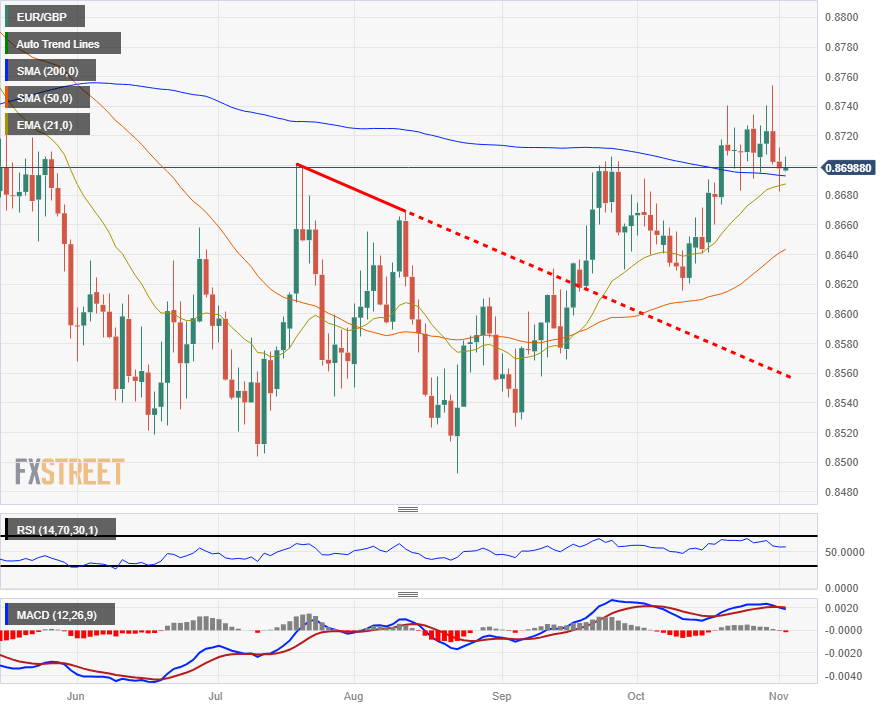

EUR/GBP Technical Outlook

The Euro's recent gains against the Pound Sterling from August's lows near 0.8500 have run into significant friction near the 200-day Simple Moving Average (SMA). Price action continues to get hung up in intraday play near the 0.8700 key level, and technical support is seeing consolidation as the 50-day SMA rises into 0.8640.

Further downside will be capped be the last meaningful swing low into 0.8620, while a topside break will see EUR/GBP prices challenging six-month highs beyond 0.8750.

EUR/GBP Daily Chart

EUR/GBP Technical Levels