USD/JPY pushing for 152.00 on thin but foamy Monday

- The USD/JPY climbed a scant twentyish pips on Monday, closes day towards the midrange.

- Yen markets saw a pop into a hefty expiry on JPY options.

- US CPI inflation numbers in the crosshairs for Tuesday.

The USD/JPY plummeted in Monday's intraday trading, skidding into 151.20 before recovering on the day.

Investors initially feared a market operation by the Bank of Japan (BoJ) to intervene on the Yen's behalf, but a large bundle of options expiries proved to be the culprit. $1.2 billion dollars in Yen options hit the deadline during Monday's US trading session, with an additional $2.2 billion in Yen options coming due in the near future.

The options expiry rallied Yen across the board before sending JPY pairs back into familiar bids.

Tuesday sees the US Consumer Price Index (CPI) inflation figures, and markets are forecasting further cooldown on US inflation.

The Headline CPI reading for October is expected to slip from 0.4% to 0.1%, while the Core CPI (CPI less volatile food and energy prices) is expected to hold steady at -0.1%.

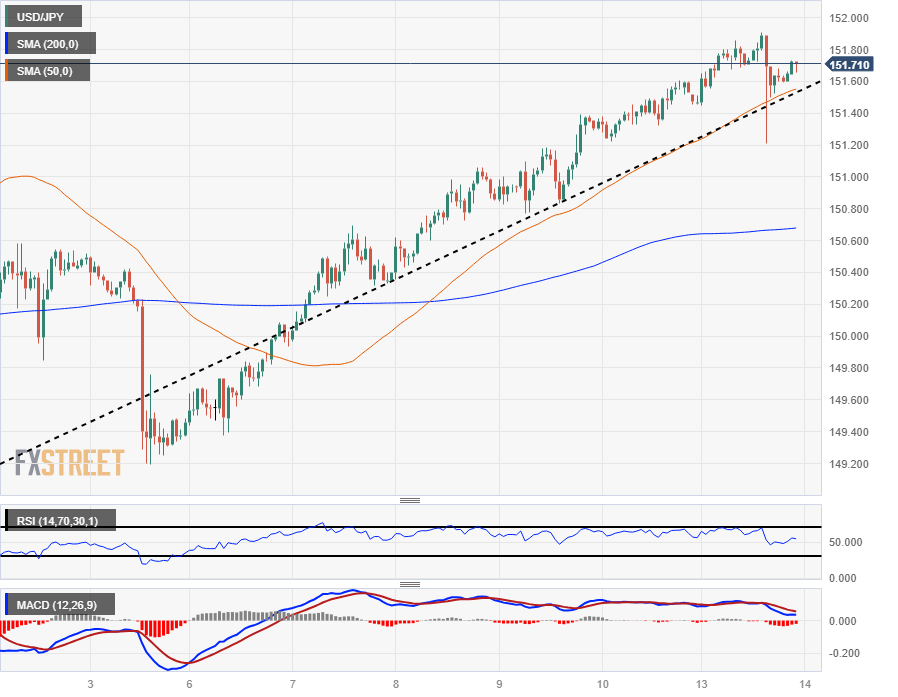

USD/JPY Technical Outlook

The Dollar-Yen hit an intraday high of 151.91, just shy of the 152.00 major handle. The pair is just inches away from clearing 2022's high bids of 151.94. A break of this level would see the USD/JPY trading into its highest prices since 1990, a 33-year high.

Intraday action has been catching bounces from technical support at the 50-hour Simple Moving Average (SMA), and traders will be keeping extra wary of any downside shock towards the 200-hour SMA currently drifting into 150.70.

USD/JPY Hourly Chart

USD/JPY Technical Levels