GBP/JPY Price Analysis: Remains on the defensive despite reclaiming 185.00

- GBP/JPY bounces off the daily low, but it remains trading in the red by 0.31%.

- Bulls would regain control once they reclaim 186.00.

- A bearish resumption would happen if GBP/JPY falls below 185.00.

GBP/JPY recovered some ground, but it remains trading with losses of 0.31%, late in the North American session, due to risk-off impulse as investors slashed bets the US Federal Reserve would cut rates as aggressively as traders expected. The cross-pair is trading at 185.86 after hitting a daily high of 186.54.

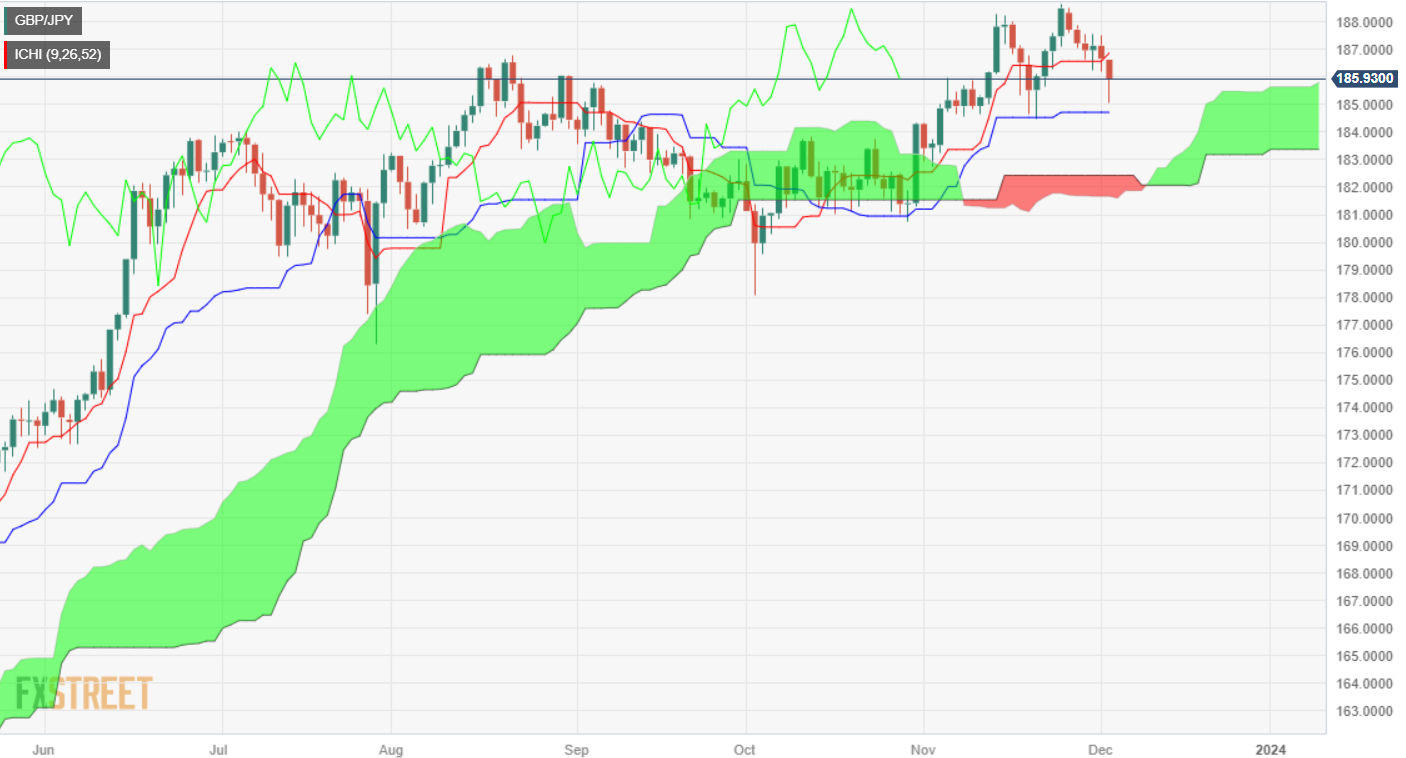

The pair dipped to a nine-day low at 185.08 before bouncing off those lows but it is hovering around the 185.80s area. That said, Monday’s price action is forming a hammer, which implies the GBP/JPY could retest higher prices. The first resistance would be the 186.00 figure, followed by the Tenkan-Sen at 186.86. Once cleared, the next resistance would be 187.00.

On the other hand, a bearish resumption could happen if GBP/JPY sellers drag prices below 185.00. That would pave the way to test the Kijun-Sen at 184.71, followed by a support trendline at around 184.25/35, before falling to the 184.00 mark.

GBP/JPY Price Analysis – Technical Outlook

GBP/JPY Technical Levels