AUD/JPY Price Analysis: Recovers from weekly losses, still bearish below 96.00

- Despite printing daily gains, the AUD/JPY is set to finish the week down by more than 2%.

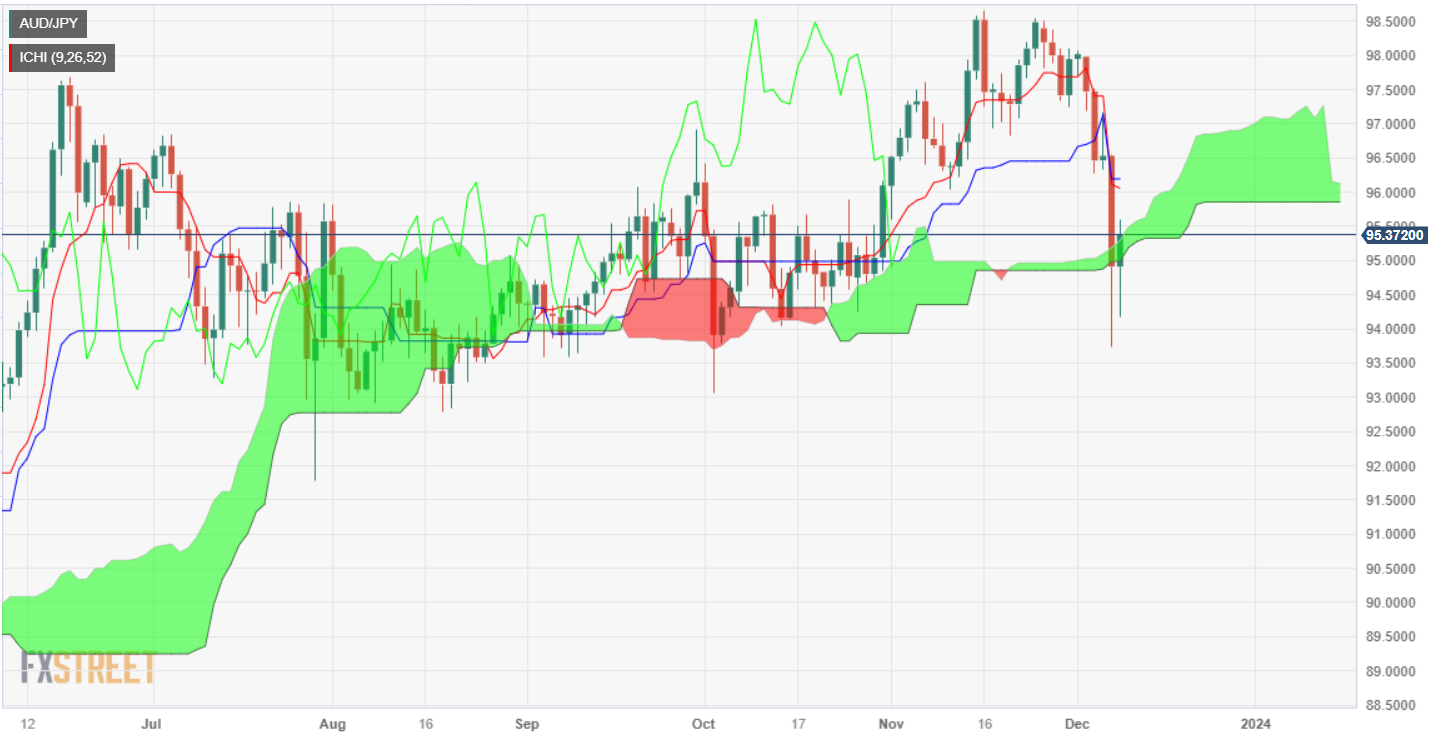

- Daily chart suggests a neutral to downward bias for the pair, with potential upside risks if a daily close is within Ichimoku Cloud boundaries.

- A daily close occurs below the top of the Kumo, the potential for further losses; with key support seen at 95.00, followed by a December 8 low of 94.17.

- Upside resistance includes November 10 swing low-turned resistance at 95.85, ahead of the 96.00 figure, and the Kijun-Sen at 96.14.

The AUD/JPY trimmed some of its Thursday’s losses on Friday, and aims higher 0.27% in late trading during the North American session. Even though the pair is up daily, would finish the week with losses of more than 2.50%, a consequence of comments by Bank of Japan’s (BoJ) Governor Ueda. Therefore, the cross is trading at 95.40, after hitting a daily low of 94.17.

The daily chart portrays the pair as neutral to downward biased, though upside risks remain. If AUD/JPY achieves a daily close within the Ichimoku Cloud (Kumo) boundaries, that could pave the way for further losses; otherwise, the pair could challenge the December 7 high of 96.49.

If AUD/JPY achieves a daily close below the top of the Kumo, the first support would be the 95.00 figure. A breach of the latter will expose the December 8 low of 94.17, ahead of the 94.00 mark

On the upside, if the pair edges above the peak of the Kumo, the first resistance would be the November 10 swing low-turned resistance at 95.85, ahead of the 96.00 figure. The next resistance would be the Kijun-Sen at 96.14.

AUD/JPY Price Analysis – Daily Chart

AUD/JPY Technical Levels