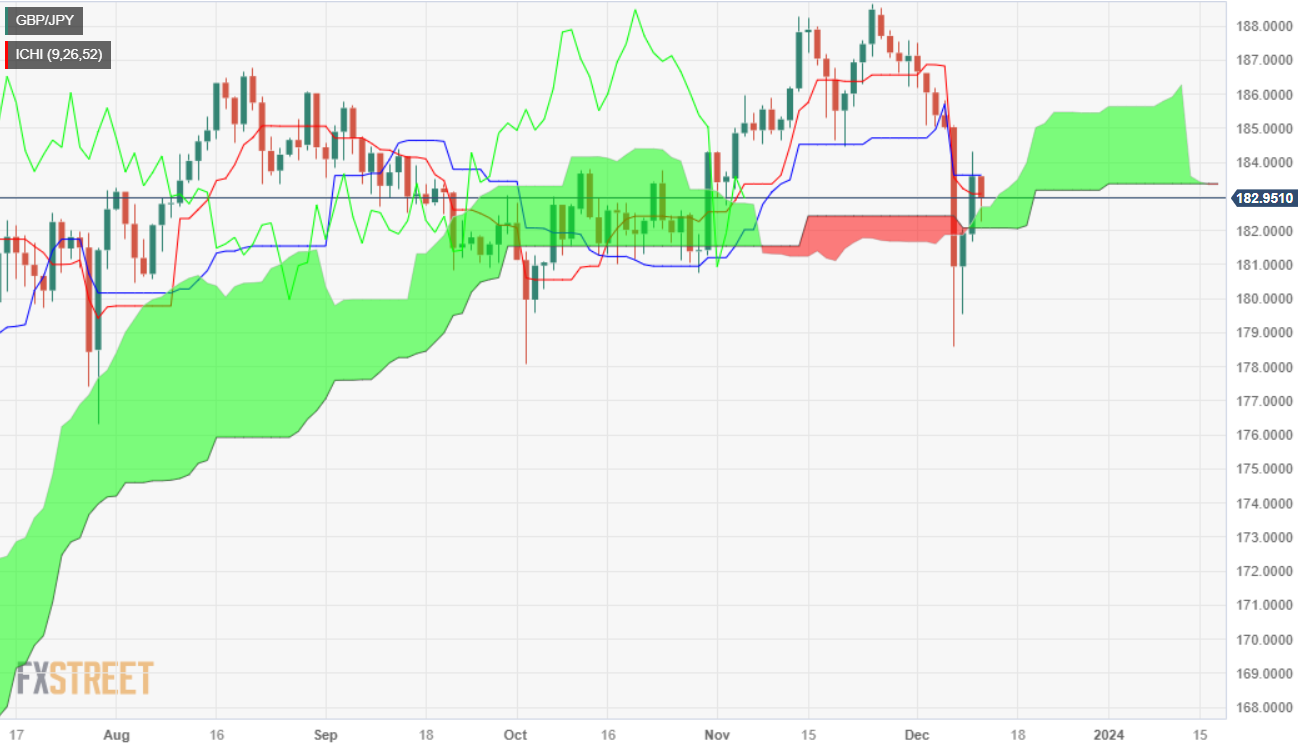

GBP/JPY Price Action: Struggles at 183.00 and dives to the top of Ichimoku Cloud

- GBP/JPY was unable to extend its gain, forming a bearish harami candlestick pattern.

- Despite being neutral, a drop inside the Kumo, and the pair could resume its downtrend.

- Buyers reclaiming a three-month-old resistance trendline could open the door to test YTD high.

Price action in the GBP/JPY remains constrained ahead of the Bank of England’s (BoE) monetary policy decision on Thursday. Although the pair has broken above the Ichimoku Cloud (Kumo), downside risks remain. At the time of writing, the cross-pair is trading at 182.94, down 0.28%.

The daily chart portrays the cross pair as neutral biased, despite breaching the Kumo. For a bullish resumption, buyers must lift the exchange rates above 185.00, breaking a three-month-old resistance trendline that passes at around that level. Once cleared, that would open the path towards the year-to-date (YTD) high at 188.80.

On the other hand, if sellers stepped in and dragged prices inside the Kumo, the pair could resume its downtrend. Key support level lies at 181.99, the bottom of the Kumo, followed by the December 11 low of 181.60. Once it drops below that level, the 180.00 mark would be up for grabs.

GBP/JPY Price Action – Daily Chart

GBP/JPY Technical Levels