GBP/JPY Price Analysis: Peaks around 188.00 post-BoJ’s decision

- GBP/JPY falls 0.26% after BoJ retains accommodative policy, hinting at future changes.

- Struggling to hold above 188.00; support at 187.00 and Tenkan-Sen 186.70.

- Rebound over 188.00 may lead to 188.92 year-to-date high, targeting 189.00, eyeing key 190.00 level.

The GBP/JPY dropped by 0.26% late in the North American session after the Bank of Japan’s (BoJ) decision to maintain monetary policy loose. However, words from BoJ Governor Kazue Ueda had opened the door to normalize policy if inflation keeps heading up. At the time of writing, the cross exchanged hands at 187.64 after hitting a high of 188.47.

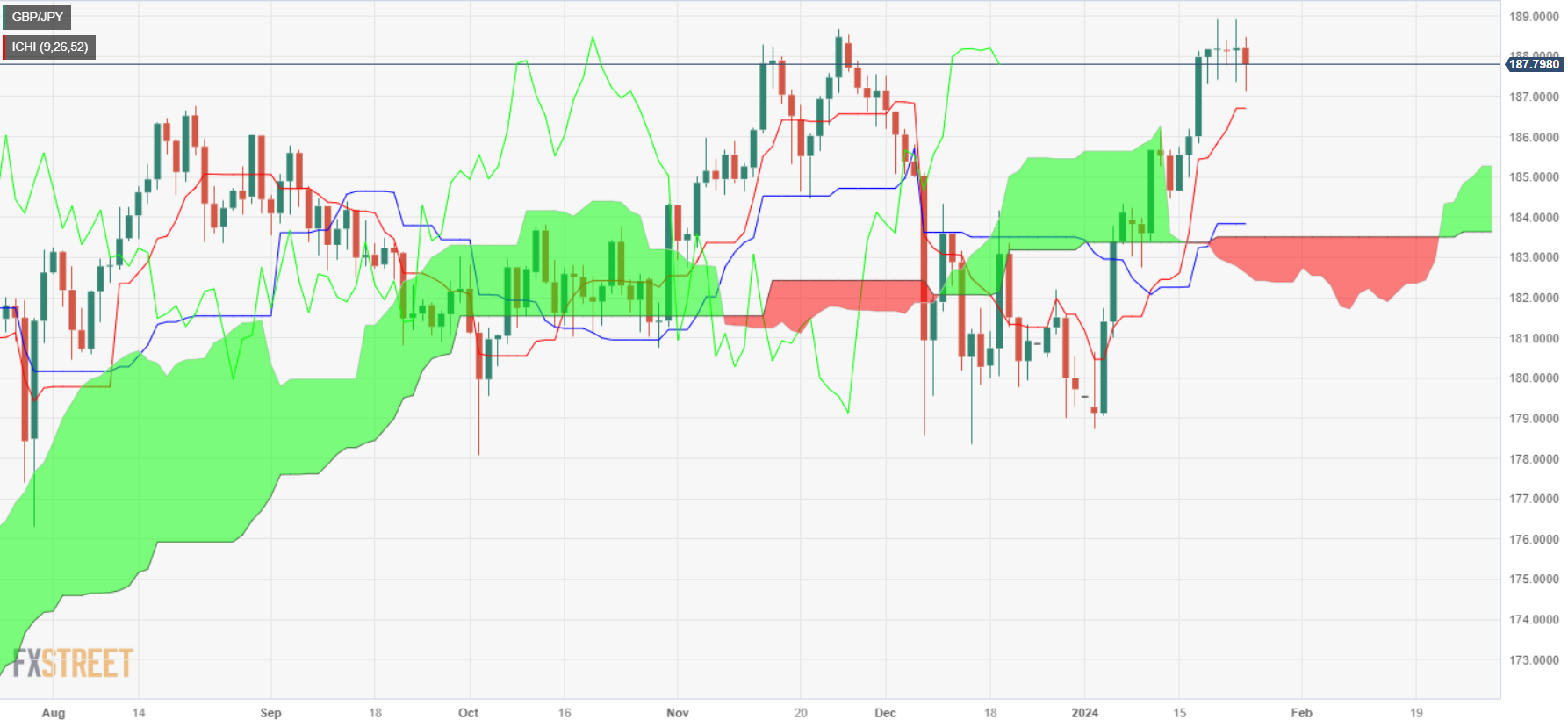

The daily chart portrays the pair peaked at around the 188.00 figure, and since sellers took over buyers, they dragged the GBP/JPY exchange rate to the 187.00 handle. Nevertheless, they must clear the psychological 187.00 barrier ahead of hurdling the Tenkan-Sen at 186.70. A breach of those two levels will expose the Senkou Span A at 185.26, followed by the 185.00 mark.

On the other hand, if GBP/JPY regains 188.00, that could pave the way to test the current year-to-date (YTD) high of 188.92, ahead of 189.00 and 190.00.

GBP/JPY Price Action – Daily Chart

GBP/JPY Technical Levels