GBP/JPY Price Analysis: Registers minimal gains amid mixed signals, hovers below 181.00

- GBP/JPY halts its slide, hinting at an upward bias with a bullish-harami two-candlestick pattern.

- Pin-bar candles and two negative sessions weigh GBP/JPY, prompting a slump below 181.00.

- GBP/JPY must surpass 180.36 for a bearish continuation; breaching the Tenkan-Sen at 181.52 could signal a bullish resumption.

GBP/JPY registers minimal gains as the Asian session begins, of 0.04% after Tuesday’s session witnessed Pound Sterling (GBP) weakness during most of the day. However, dovish comments from the Bank of Japan (BoJ) Governor Kazuo Ueda weighed on the Japanese Yen (JPY). At the time of writing, the GBP/JPY exchanges hands at 180.99.

GBP/JPY Price Analysis: Technical outlook

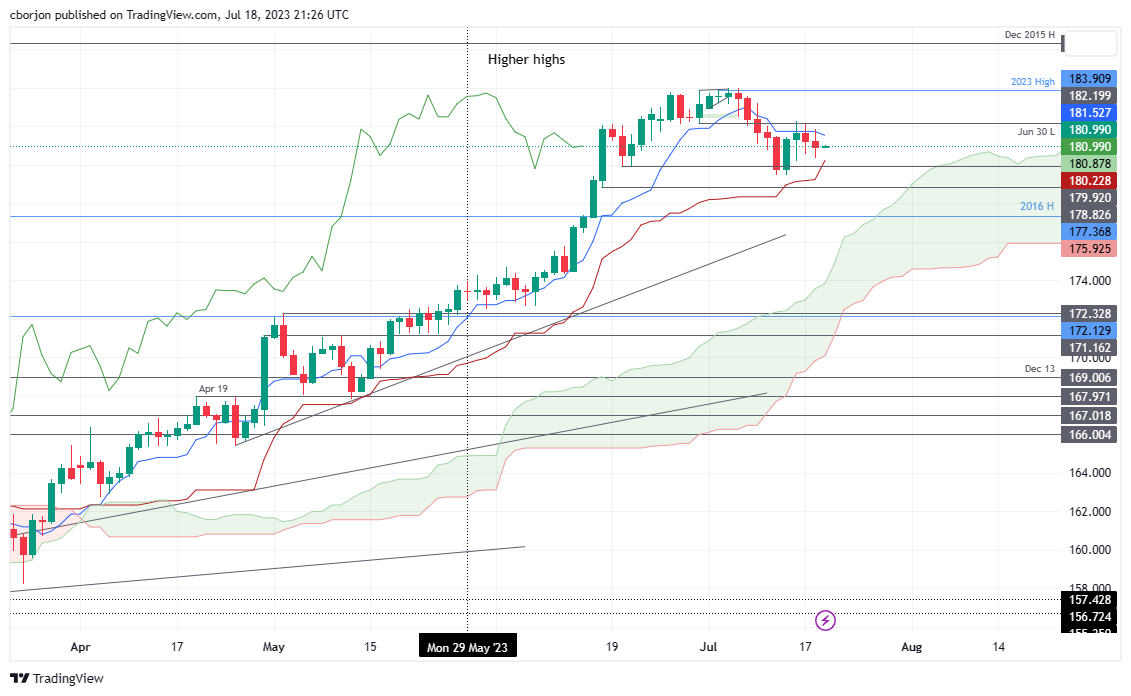

The daily chart portrays the cross as upward biased after stopping its slide on July 13 as a bullish-harami two candlestick pattern, suggesting prices would increase. Nevertheless, subsequent pin-bar candles and two negative sessions weighed on the GBP/JPY, slumping from around 182.19, just below the 181.00 figure.

For a bearish continuation, the GBP/JPY must surpass the July 17 low of 180.36, followed by the Kijun-Sen at 180.23. Once cleared, GBP/JPY must test 180.00, aiming toward lower price levels. Contrarily, for the GBP/JPY to resumeits uptrend, the first resistance would be the Tenkan-Sen at 181.52. Once that level hurdled, GBP/JPY would test June 30 daily low turned resistance at 182.20, followed by the year-to-date (YTD) high at 183.90.

GBP/JPY Price Action – Daily chart