EUR/JPY Price Analysis: Shy of hitting YTD high above 161.00 as doji looms

- EUR/JPY hits year-to-date high, buoyed by positive sentiment and BoJ dovish comments.

- Above 161.00, eyes on 162.00 resistance; below 160.27 swing low may test 160.00 support.

- Technical analysis hints at pullback, with critical supports at 160.00, today’s low 160.77, and pivot 160.46

The EUR/JPY pierces the 161.00 figure and hits a two-week high of 161.26, courtesy of a risk-on impulse and “dovish” comments by a Bank of Japan (BoJ) member. At the time of writing, the pair hovers around 161.00, clocking minimal 0.05% gains.

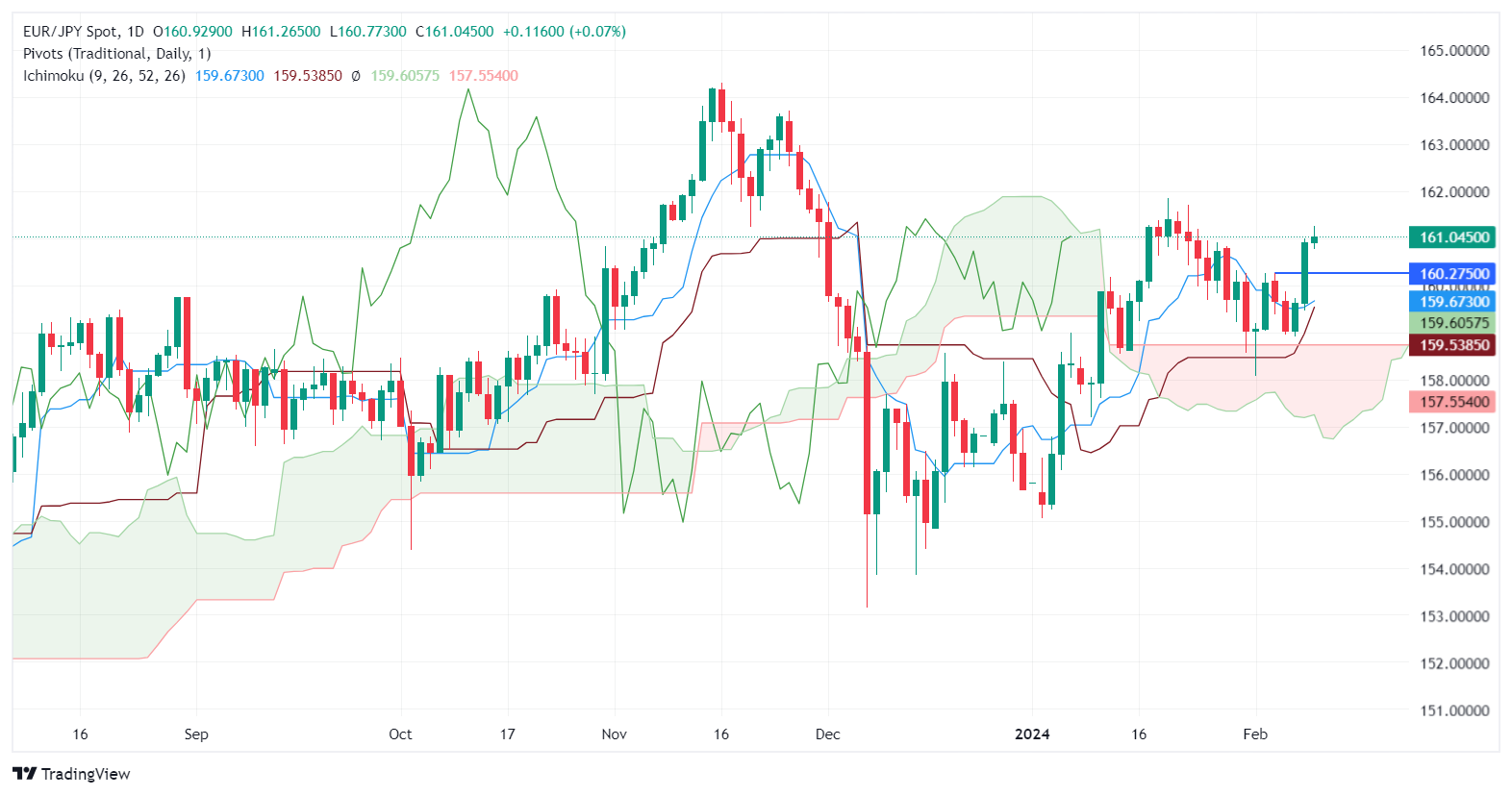

The daily chart portrays the EUR/JPY pair is upward biased. Still, Friday’s price action is shaping a doji, which indicates neither buyer's nor sellers' commitment to their positions. With that said, if buyers reclaim 161.00, look for an upside move to 162.00. On the flip side, if sellers step in and clear the February 5 swing low of 160.27, that could pave the way to challenge 160.00.

EUR/JPY Price Action – Daily Chart

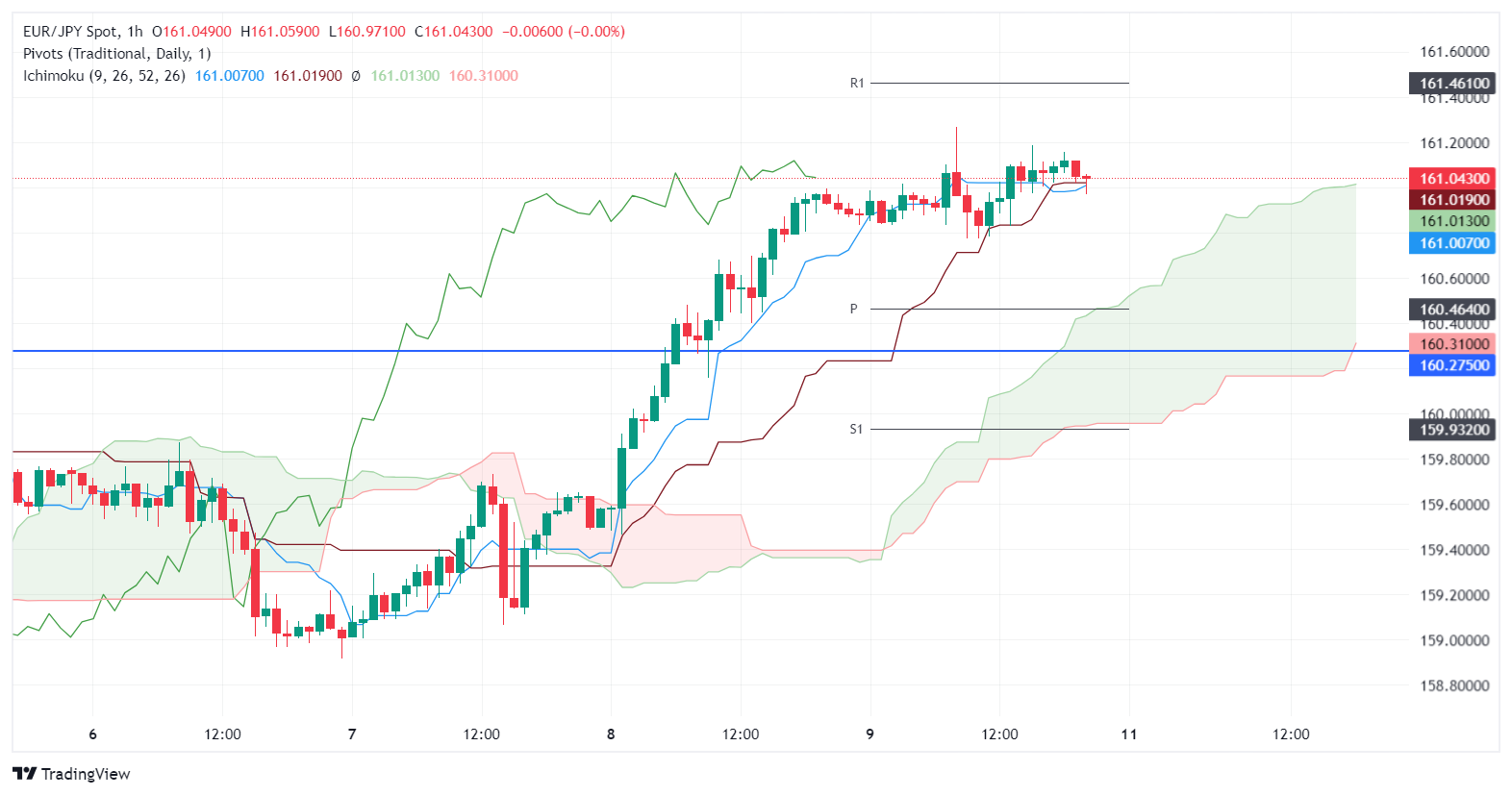

In the short term, the divergence between EUR/JPY price action and Relative Strength Index (RSI) studies could open the door for a pullback. The first support is seen at 160.00 the confluence of the Tenkan and Kijun-Sen, followed by today’s low of 160.77, followed by the daily pivot at 160.46.

EUR/JPY Price Action – Hourly Chart