EUR/JPY Price Analysis: Slumps and breaks key support, sellers’ eye 161.00

- EUR/JPY falls 0.80% to 162.00, reacting to BoJ's hawkish comments and soft EU inflation data.

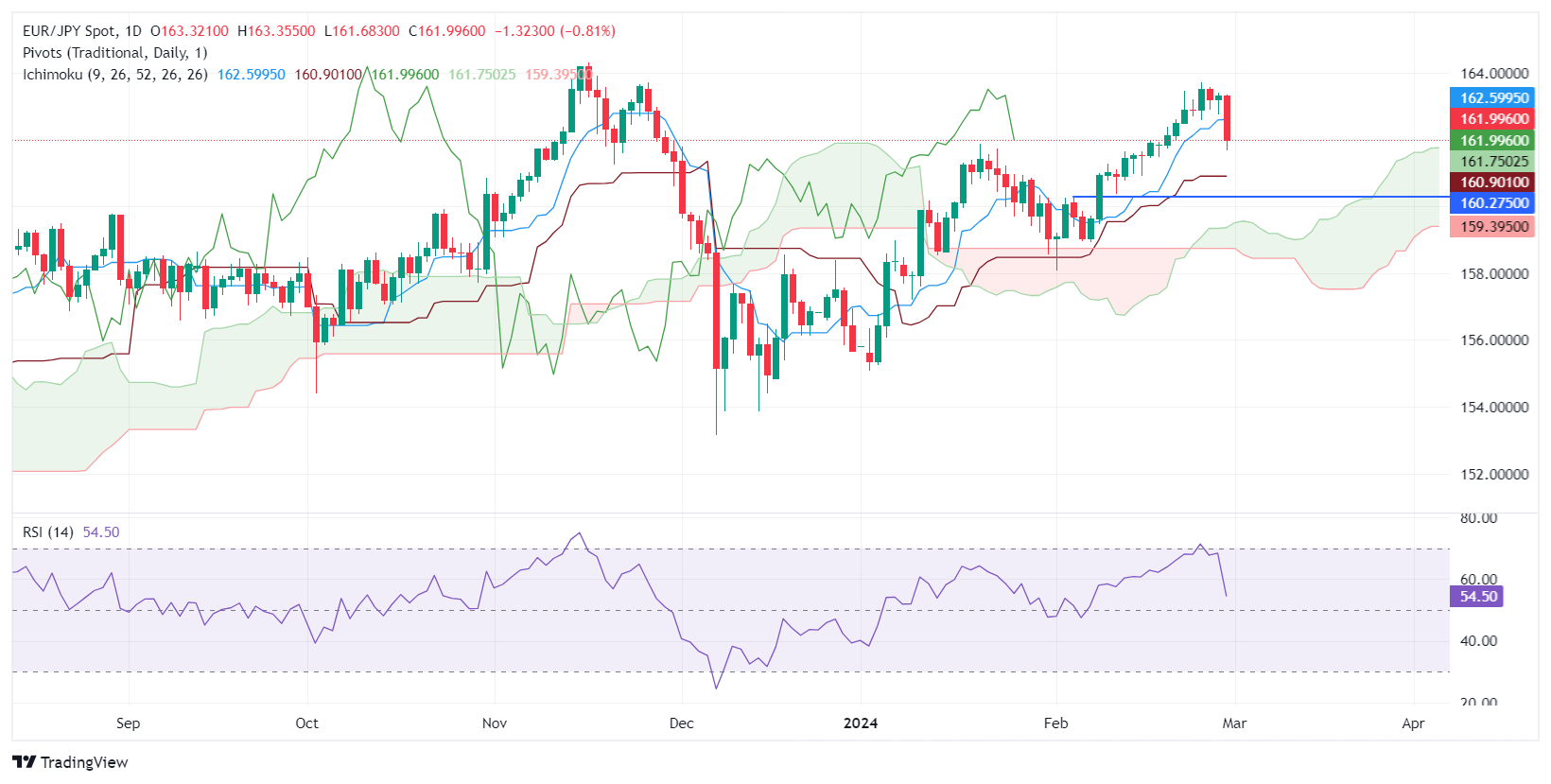

- Technical analysis indicates crucial support and resistance levels, highlighting immediate market sensitivities.

- Further decline eyed with key supports at 161.75 and 161.00, unless buyers reclaim higher resistance points.

The EUR/JPY snaps two days of gains and drops on Thursday, following hawkish remarks by a Bank of Japan (BoJ) official. That and soft inflation data from countries in the Eurozone (EU) area are driving the cross-pair price action ahead of the Wall Street close. At the time of writing, the pair exchanged hands at 162.00, down 0.80%.

EUR/JPY Price Analysis: Technical outlook

The pair fell below 162.59, the Tenkan-Sen level, and slumped below the 162.00 figure, hitting a daily low of 161.68. However, the EUR/JPY recovered and reclaimed 162.00, though downside risks remain. If sellers achieve a daily close below 162.00, further weakness lies ahead. The next support would be the Senkou Span A at 161.75, followed by the 161.00 mark, and the Kijun Sen at 160.90.

Conversely, if buyers stepped in, stir resistance lies at 164.00, but firstly, they need to conquer the Tenkan-Sen at 162.59 before the 163.00 mark.

EUR/JPY Price Action – Daily Chart