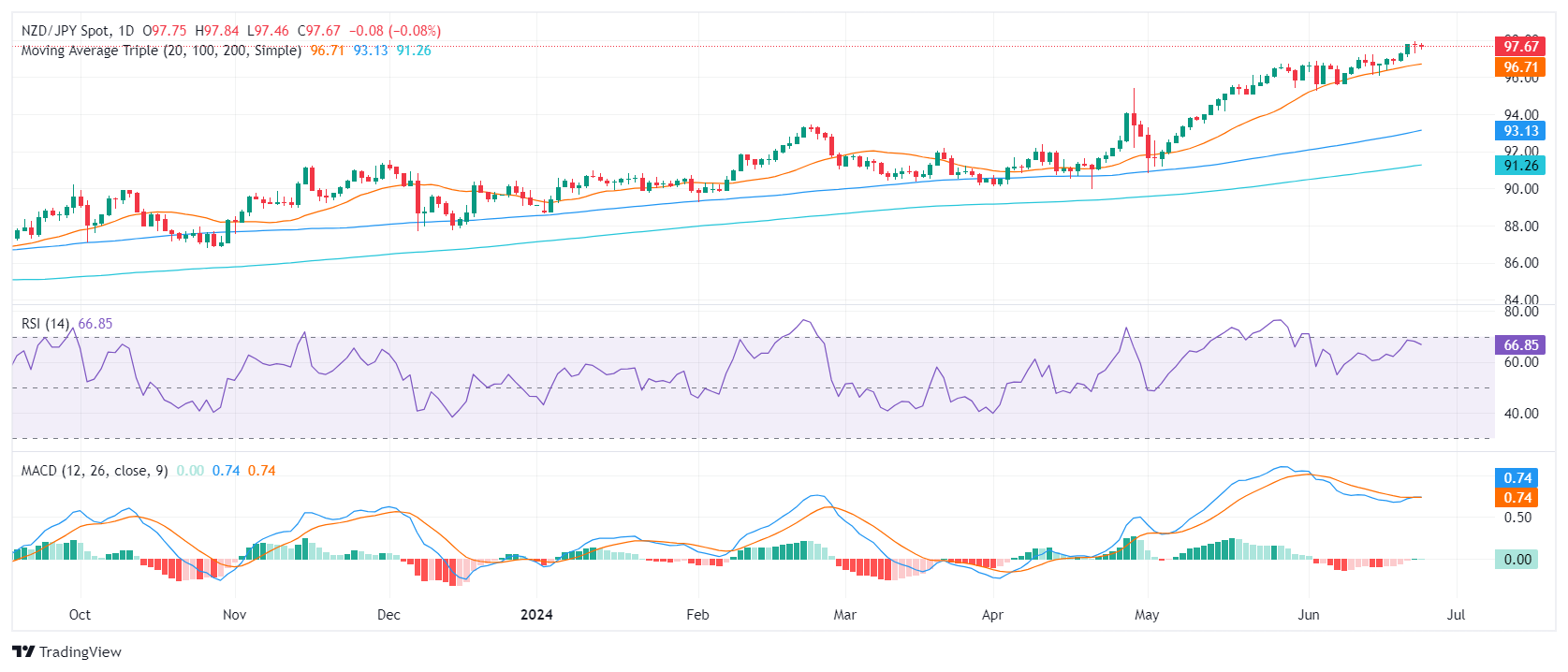

NZD/JPY Price Analysis: Cross continues consolidating, still above 97.00

- NZD/JPY remains stable at 97.60, as the pair starts consolidating.

- The 20-day SMA at 96.30 offers considerable support against a potential correction.

- Despite the consolidation phase, the bullish outlook persists, eyeing the next key resistance at 98.00.

On Tuesday, the NZD/JPY cross appeared to have entered a consolidation phase, retaining its footing at the fresh high of 97.80. Flaunting its resilience, the pair maintained its strong support at the 20-day Simple Moving Average (SMA) of 96.30, while hovering at high levels not witnessed since July 2007. The bullish outlook remains undisputed, despite the necessity for a healthy correction to address the overbought conditions.

The daily Relative Strength Index (RSI) currently stands at 66, a decline from Monday's 68, hinting at an impending downtrend. However, it remains within a positive territory devoid of extreme conditions. Meanwhile, the Moving Average Convergence Divergence (MACD) prints flat red bars which implies diminishing buying pressure as a shift towards a potential consolidation or correction phase.

NZD/JPY daily chart

The steady grip of bulls above the 20-day SMA illustrates their strength, coupled with the technical indicators nearing overbought status, this further cements the positive technical outlook of the Kiwi against the Yen. However, overbought conditions necessitate a healthy correction or consolidation to ensure sustained upward momentum.

As investors anticipate subsequent trading sessions, the focus is on the immediate support at 97.00 and the resistance target at 98.00. A sustained break above the consolidation range could validate further upside while slipping below the 20-day SMA could indicate a deeper correction.