EUR/USD slumps amid EU’s recessionary fears ahead of Fed and ECB’s decisions

- Mixed PMI data from the US tempers some optimism, with the market now eyeing ISM Manufacturing and Services PMI release in August.

- Eurozone PMI data points to a deepening recession, exacerbated by downward inflation trends and shifting stances amongst ECB’s hawkish members.

- Deteriorating German business confidence adds to the bearish outlook for the Euro, compounding economic struggles in the bloc’s largest economy.

The EUR/USD slides for the fifth straight session as recessionary Eurozone (EU) fears arose. Simultaneously, traders prepare for the release of the US Federal Reserve (Fed) monetary policy decision on Wednesday, followed by the European Central Bank (ECB) on Thursday. The EUR/USD is trading at 1.1051 after hitting a daily high of 1.1086.

Economic indicators and central bank meetings on both sides of the Atlantic poised to shape the currency pair’s movements

Wall Street continues to drive market mood, with earnings of mega-tech companies, like Microsoft and Google underpinning US bourses. Economic data from the United States (US) showed that consumer confidence is rising, despite foreseeing an upcoming recession in the US, as revealed by the Conference Board (CB) poll. That and house prices boosted the US Dollar (USD) early in the North American session, as the EUR/USD dived to a new weekly low of 1.1020.

The EUR/USD extended its fall on Monday after S&P Global PMIs in the US were mixed, as manufacturing activity improved, but services slumped. Nevertheless, the three-point rise in Manufacturing PMI, from 46.1 to 49, cushioned the Composite PMI reading to 52, from June’s 53.2. Even though figures painted an optimistic outlook in the US, traders would eye the ISM Manufacturing and Services PMI release at the beginning of August.

Contrarily, the Eurozone (EU) is portraying a dismal scenario with manufacturing activity across France, Germany, and the whole EU missing estimates and plunging deeper into recessionary territory, igniting fears that a recession can hit the bloc. Last week’s inflation data pointing downwards, and a sudden change of stance amongst ECB’s most hawkish members in Klas Knot and Joachim Nagel, shifting to a data-dependant mode, could weaken the Euro (EUR) in the near term.

In the meantime, early in the Europe session, business confidence in Germany slipped further, a headwind for the EUR/USD. Analysts warned that Germany’s economy is struggling to recover from a recession, as the Ifo Business Climate stood at 87.3, below the 88.0 consensus.

Given the backdrop, the Federal Reserve is expected to deliver a 25 bps rate increase, with traders eyeing Fed Chair Jerome Powell’s press conference for clues regarding the forward path of monetary policy. Across the pond, the ECB is also expected to lift rates by 25 bps on Thursday, but odds for September continued to diminish as the EU’s economy decelerates.

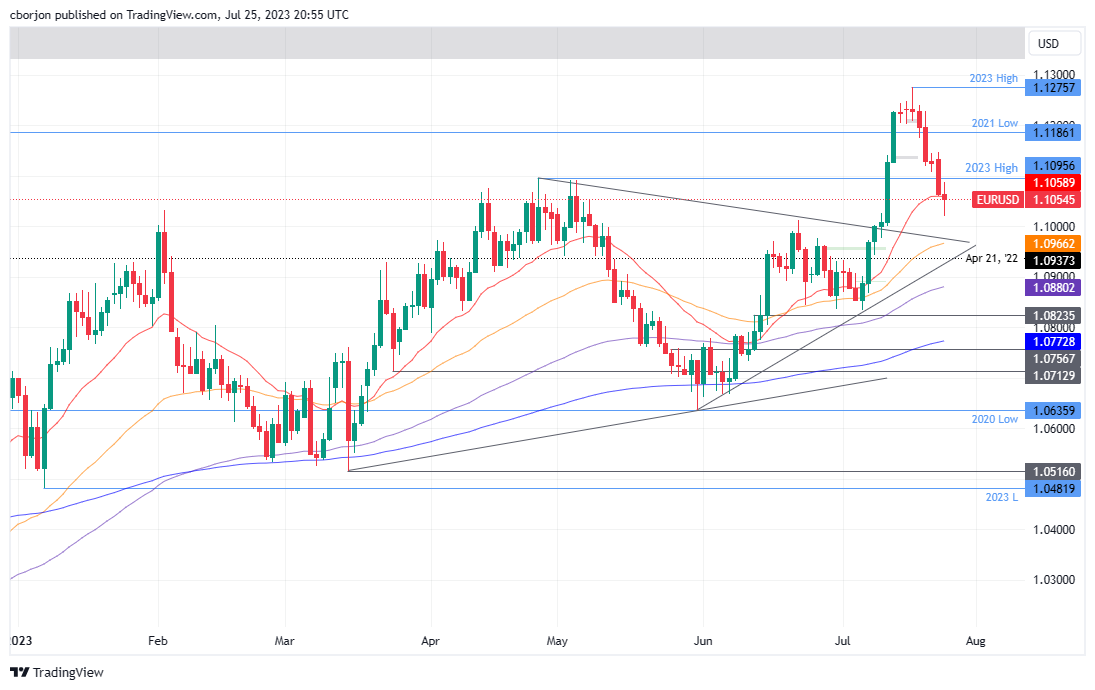

EUR/USD Price Analysis: Technical outlook

From a technical standpoint, the EUR/USD is neutrally biased, though it halted its ongoing downtrend at the 20-day Exponential Moving Average (EMA) at 1.1058. A daily close below the latter will expose key support levels, like the 1.1000 figure, followed by the 50-day EMA at 1.0966. Conversely, if EUR/USD buyers stepped in at that level, the major could edge toward the 1.1100 mark, followed by the test of the 1.1200 mark.

EUR/USD Daily chart