WTI Price Analysis: Bears are waiting to pounce but bulls putting up a fight

- WTI is attempting to breakdown but the bulls stay in charge.

- A break of $79.00 is required for bearish thesis to be solidified.

WTI crude also rose 4.6% for the week, marking the fifth consecutive weekly increase, the longest winning streak since the week ending June 10, 2022. This leaves the longs exposed for the days ahead with the past 5 weeks of fundamentals playing in and ripe for a squeeze despite this week's EIA data that was skewed slightly bullish.

The following analysis is leaning bearish, but there are a number of developments that need to occur to conclude the thesis of a long squeeze for the week ahead:

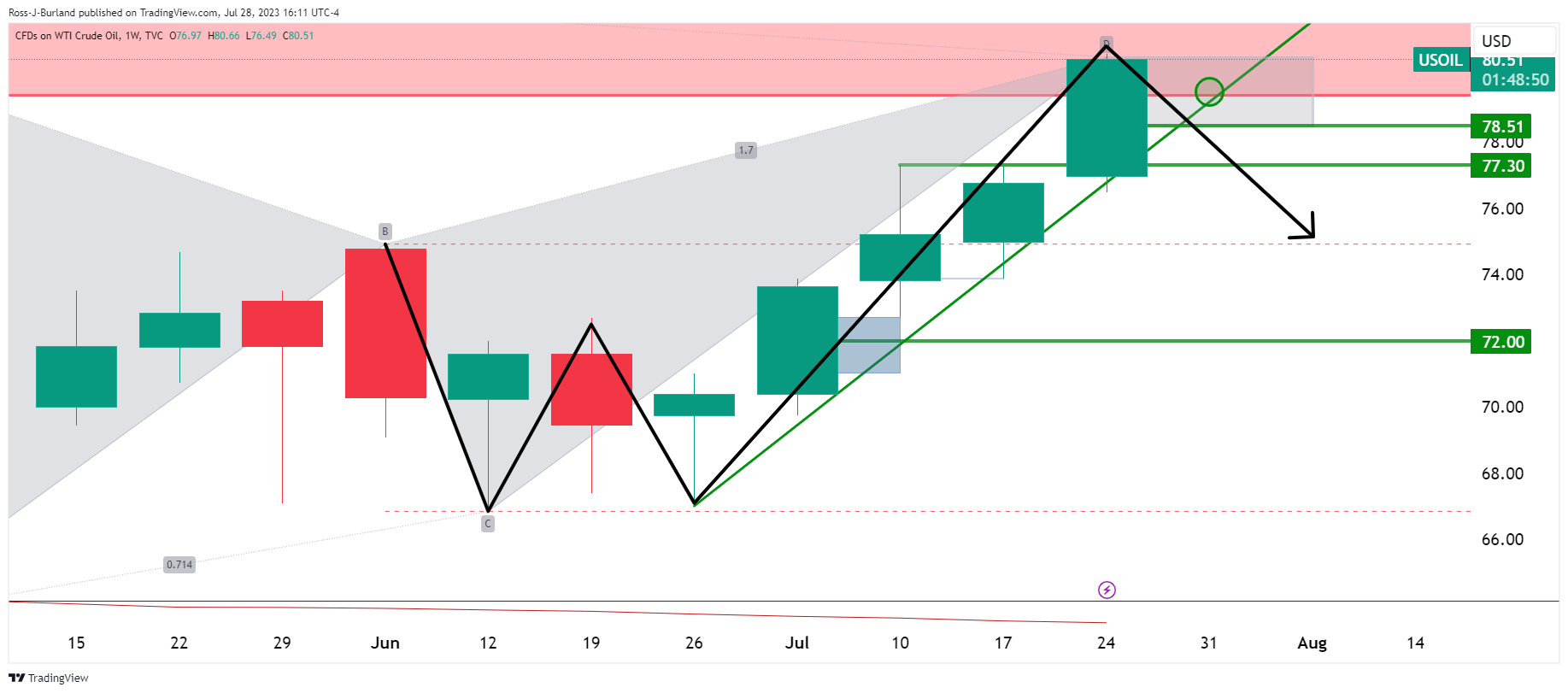

WTI weekly charts

The bearish Gartley is compelling as is the weekly W-formation:

However, the price is still very much front side of the bullish trendline.

WTI daily charts

Do we have a final peak formation coming into play with trapped longs up top?

The daily chart's W formation is also compelling, although has it failed to draw in the price? So far the bulls stay in control into weekly resistance.

WTI H4 chart

A break of the trendline is required and we also need to see a breakout $79 structure before a bearish thesis can be solidified.