Canadian Dollar trims weight again, taps new 11-week low

- The Canadian Dollar lost another tenth of a percent against the Greenback.

- Canada took a backseat with US PMIs featuring heavily on Thursday’s data docket.

- The BoC’s 50 bps rate trim this week is doing little to support the CAD.

The Canadian Dollar (CAD) eased slightly on Thursday, trimming another tenth of a percent against the Greenback as global FX markets continue to turn their backs on the Loonie following the Bank of Canada’s (BoC) midweek rate trim.

Canada saw strictly low-tier data on the economic calendar docket, and broadly upbeat US Purchasing Managers Index (PMI) activity figures bolstered the US Dollar across the board.

Daily digest market movers

- US PMI figures beat on both sides of the forecast, with Services climbing to 55.3 in October compared to the expected 55.0, and slightly beating September’s 55.2.

- The US Manufacturing PMI component also rose, climbing to 47.8 from the previous 47.3, beating the expected rise to 47.5.

- US Initial Jobless Claims also eased back to 227K for the week ended October 18. Markets expected a print matching the previous week’s revised 242K.

- Canadian Employment Insurance Beneficiaries Change fell in August to 1.5% from the previous month’s 2.2%. Little market impact came of it.

- Canadian Retail SAales figures from September are slated for Friday, but likely to get overshadowed by US Durable Goods Orders and University of Michigan Consumer Sentiment figures due at the same time.

Canadian Dollar price forecast

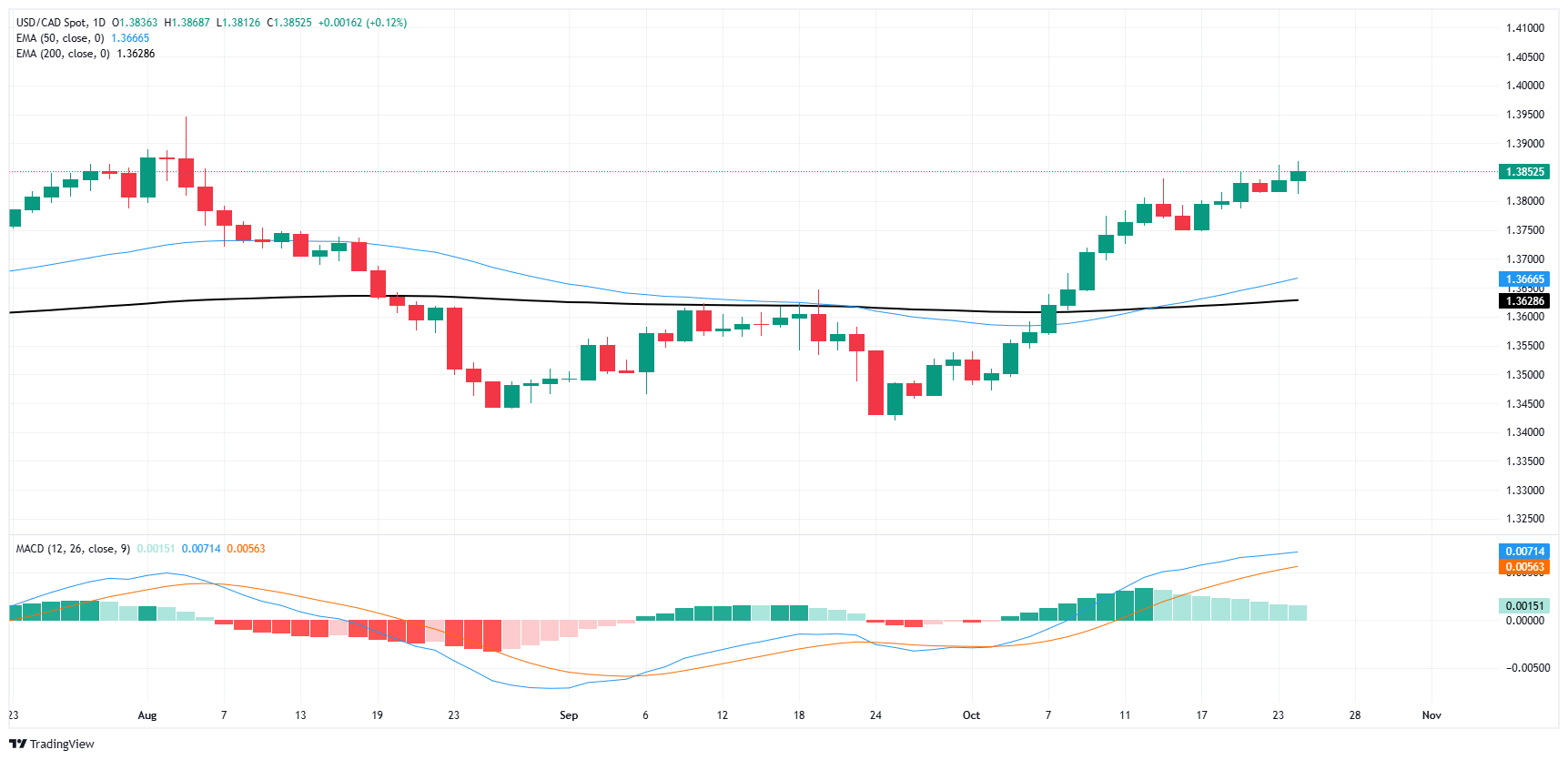

The USD/CAD pair is currently trading in a bullish trend after recovering from a prolonged period of downward movement seen in mid-August through late September. The price has decisively broken above both the 50-day EMA (blue line) at 1.3666 and the 200-day EMA (black line) at 1.3628, indicating a shift in market sentiment towards the upside. The recent bullish momentum has been strong, with the pair consolidating near the 1.3850 level after a steady rise. The moving averages are beginning to converge, suggesting the possibility of a medium-term bullish crossover that would further support upward momentum.

Looking at the MACD indicator at the bottom of the chart, the bullish divergence is evident as the MACD line (blue) is crossing above the signal line (orange), confirming the recent bullish trend. The histogram also shows increasing positive momentum, with expanding green bars. However, the price appears to be approaching a key resistance area around the 1.3850-1.3900 level, where the pair might face selling pressure. Traders should watch for a potential retracement or consolidation phase if this resistance holds, with support levels around the 1.3700 mark, where the 50-day EMA could offer a safety net for bulls. A clear break above 1.3900, however, could open the doors for further gains toward the 1.4000 psychological level.

USD/CAD daily chart

Canadian Dollar FAQs

The key factors driving the Canadian Dollar (CAD) are the level of interest rates set by the Bank of Canada (BoC), the price of Oil, Canada’s largest export, the health of its economy, inflation and the Trade Balance, which is the difference between the value of Canada’s exports versus its imports. Other factors include market sentiment – whether investors are taking on more risky assets (risk-on) or seeking safe-havens (risk-off) – with risk-on being CAD-positive. As its largest trading partner, the health of the US economy is also a key factor influencing the Canadian Dollar.

The Bank of Canada (BoC) has a significant influence on the Canadian Dollar by setting the level of interest rates that banks can lend to one another. This influences the level of interest rates for everyone. The main goal of the BoC is to maintain inflation at 1-3% by adjusting interest rates up or down. Relatively higher interest rates tend to be positive for the CAD. The Bank of Canada can also use quantitative easing and tightening to influence credit conditions, with the former CAD-negative and the latter CAD-positive.

The price of Oil is a key factor impacting the value of the Canadian Dollar. Petroleum is Canada’s biggest export, so Oil price tends to have an immediate impact on the CAD value. Generally, if Oil price rises CAD also goes up, as aggregate demand for the currency increases. The opposite is the case if the price of Oil falls. Higher Oil prices also tend to result in a greater likelihood of a positive Trade Balance, which is also supportive of the CAD.

While inflation had always traditionally been thought of as a negative factor for a currency since it lowers the value of money, the opposite has actually been the case in modern times with the relaxation of cross-border capital controls. Higher inflation tends to lead central banks to put up interest rates which attracts more capital inflows from global investors seeking a lucrative place to keep their money. This increases demand for the local currency, which in Canada’s case is the Canadian Dollar.

Macroeconomic data releases gauge the health of the economy and can have an impact on the Canadian Dollar. Indicators such as GDP, Manufacturing and Services PMIs, employment, and consumer sentiment surveys can all influence the direction of the CAD. A strong economy is good for the Canadian Dollar. Not only does it attract more foreign investment but it may encourage the Bank of Canada to put up interest rates, leading to a stronger currency. If economic data is weak, however, the CAD is likely to fall.