NZD/JPY Price Analysis: Sideways movement continues with bearish tone

- NZD/JPY pair remains directionless, showing a lack of clear upward or downward momentum.

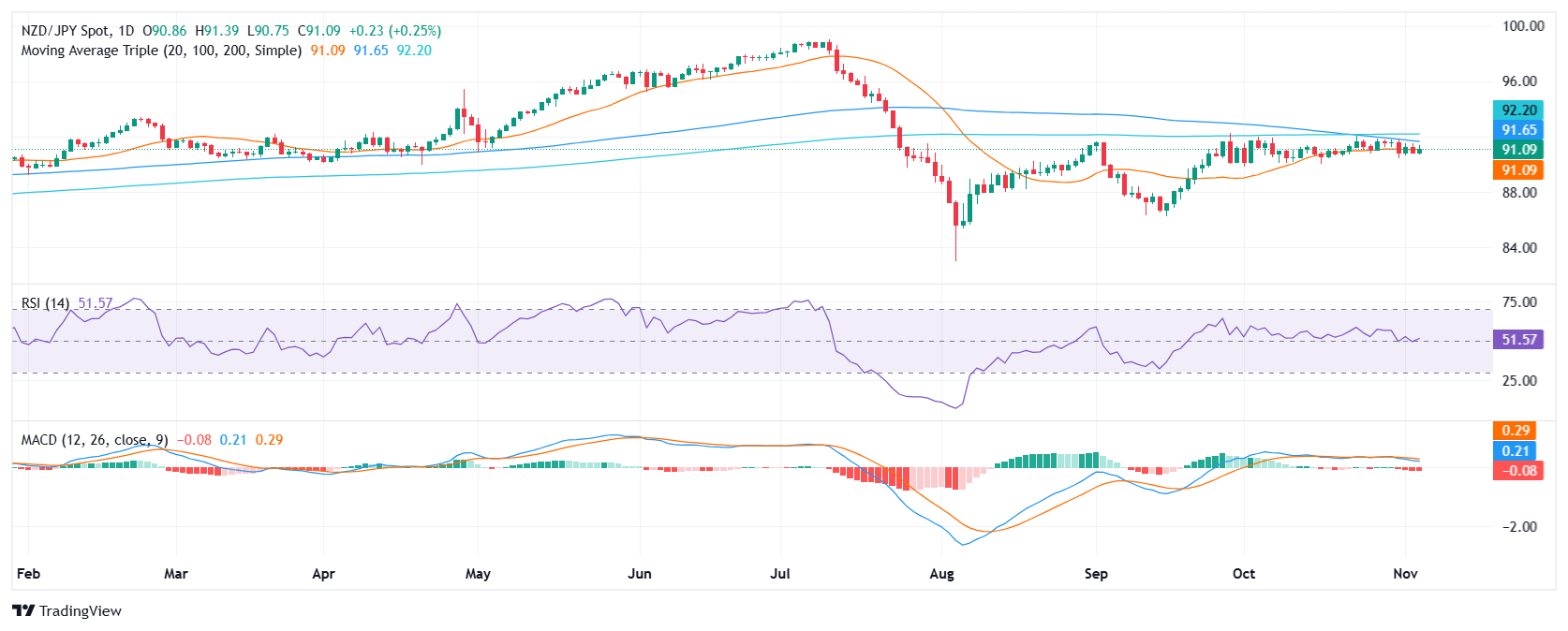

- Sellers maintain some control as the pair remains below its 20-day Simple Moving Average.

The NZD/JPY pair has been trading sideways over the past sessions, consolidating within a range and rose to 91.10 on Tuesday. Bears continue to win small battles and are slowly pushing the cross below the 20-day Simple Moving Average (SMA).

The Moving Average Convergence Divergence (MACD) histogram presents rising red bars, indicating increasing selling pressure. However, the Relative Strength Index (RSI) is rising from the midpoint, suggesting a potential recovery in buying momentum. Overall, the technical outlook for NZD/JPY remains mixed, with no clear trend emerging but with some selling signals emerging.

Traders can closely monitor key support and resistance levels to gauge market sentiment. Support levels currently stand at 91.00, 90.70 and 90.30, while resistance levels reside at 91.30, 91.50, and 92.00.

The prevailing range-bound movement aligns with the mixed technical outlook, indicating indecision in the market. Until a clear break above or below these support and resistance levels occurs, the sideways movement is likely to continue.

NZD/JPY daily chart