NZD/JPY Price Analysis: Pair retreats, bearish SMA crossover completed

- NZD/JPY declines on Wednesday, trading near 91.45.

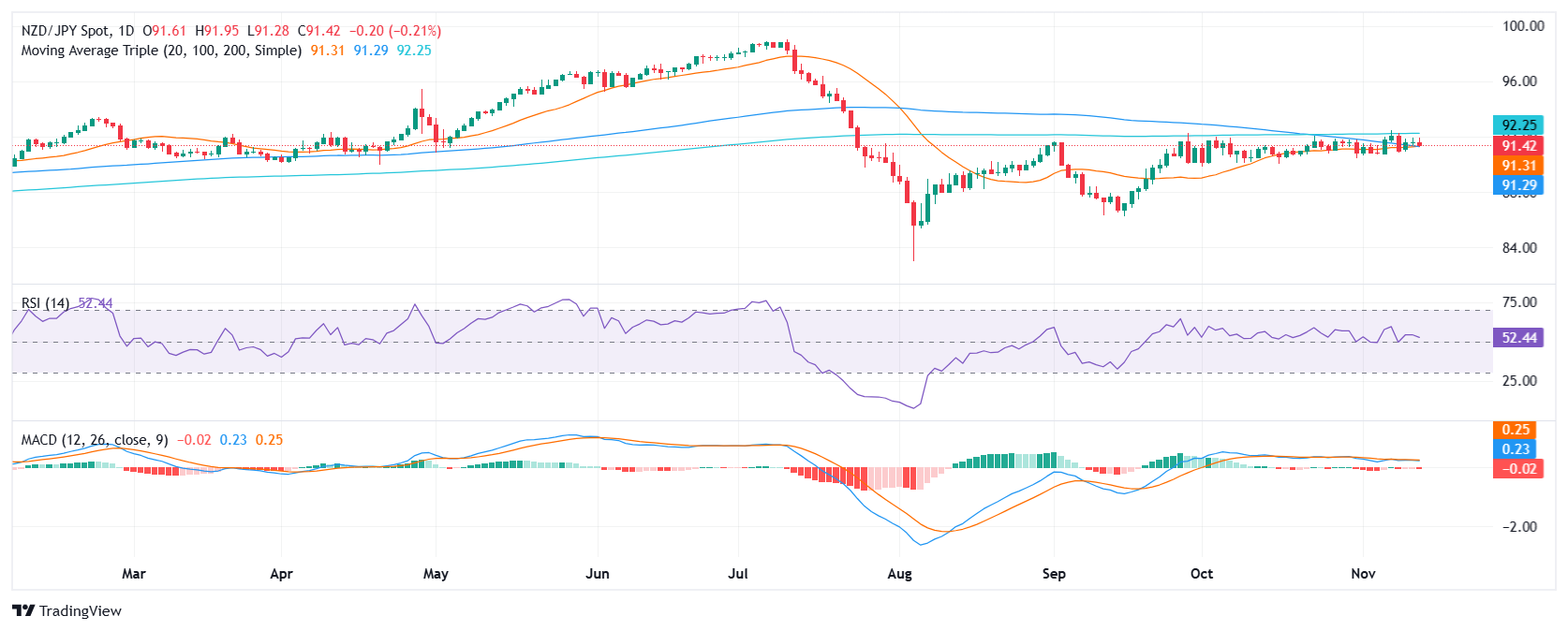

- The pair completed a bearish crossover between the 20 and 100-day SMA.

- The RSI and MACD technical indicators suggest the NZD/JPY pair outlook remains mixed.

The NZD/JPY pair witnessed a slight pullback during Wednesday's session, dipping below the 91.50 level. This retracement follows a period of gains on Tuesday, but the pair remains confined within a clear trading channel between 92.00 and 91.00. Additionally A bearish crossover, recently completed between the 20 and 100-day Simple Moving Average (SMA) might push the pair lower.

Technically, the Relative Strength Index (RSI) suggests that buying pressure is declining, as it stands at 53, in positive terrain, but declining. Additionally, the Moving Average Convergence Divergence (MACD) histogram is flat and red, suggesting that selling pressure is present. Therefore, the overall outlook for the pair remains mixed, and it is worth monitoring the price action around the 91.00 and 92.00 boundaries.

Support levels are located at 91.00, 90.50, and 90.00, while resistance levels are at 92.00, 92.50, and 93.00.

NZD/JPY daily chart