GBP/JPY Price Analysis: Aims towards 183.00, as technicals suggest consolidation in the short term

- GBP/JPY experiences gains for the second consecutive day, peaking at a weekly high of 182.95.

- Chikou Span is on the verge of a bullish signal, while flat Tenkan-Sen and Kijun-Sen lines hint at potential subdued movement.

- The 183.00 mark remains pivotal; a breakthrough could lead to testing the YTD high of 184.01.

- Downside risks include supports at 181.37 (August 8 low) and the Ichimoku Cloud top around 180.50/60.

GBP/JPY advanced for the second consecutive day on Tuesday, registering gains of 0.36%, reaching a fresh weekly high of 182.95. Nevertheless, toward the close of the day, the GBP/JPY dipped, and as the Asian session began, the GBP/JPY exchanges hands at 182.65, down 0.03%.

GBP/JPY Price Analysis: Technical outlook

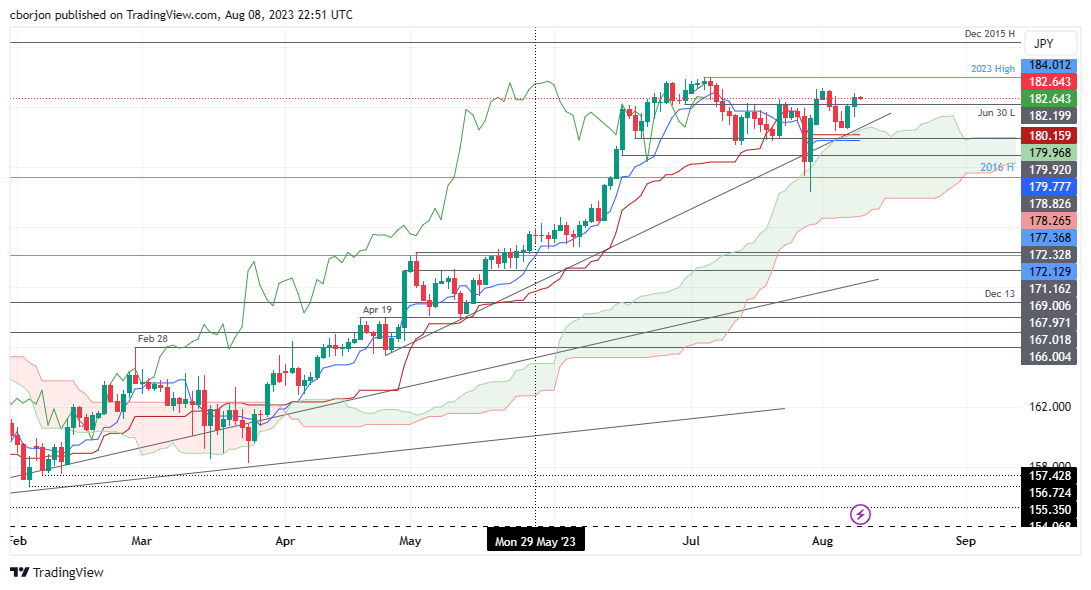

The GBP/JPY remains neutral to upward biased, poised to re-test the year-to-date (YTD) high of 184.01, even though it remains below 183.00. It should be said the Chikou Span is about to give a bullish signal, about to break above price action; however, the Tenkan-Sen remains below the Kijun-Sen, with both lines remaining flat, suggesting the GBP/JPY could remain subdued in the near term.

If GBP/JPY breaks to a new weekly high, the first resistance would be the 183.00 figure. A breach of the latter would expose the August 1 high of 183.24, followed by the YTD high of 184.01

Conversely, if GBP/JPY remains below 183.00, that could open the door for a pullback. First support will emerge at the August 8 daily low of 181.37. The following support would be the top of the Ichimoku Cloud (Kumo) at around 180.50/60, followed by the Kijun-Sen and Tenkan-Sen lines, each at around 180.16 and 179.77, respectively.

GBP/JPY Price Action – Daily chart