Gold price slumps beneath $3,300 as Fed Minutes signal stagflation risks and patience

- Gold drops 0.27% after Fed cites tariff-driven inflation concerns; yields rebound, stalling bullion’s rally.

- Fed minutes highlight risks of persistent inflation and weakening job growth, prompting cautious rate stance.

- US bond yields rebound, lifting the Dollar and pressuring Gold below $3,300.

- Goldman Sachs urges increased Gold exposure amid rising geopolitical risks and central bank demand.

Gold price extended its losses during the North American session on Wednesday after hitting a daily high of $3,325 earlier in the day, as market participants digested the latest Federal Reserve (Fed) policy minutes. At the time of writing, XAU/USD trades below $3,300, resulting in a solid 0.27% decline.

On May 6-7, the Fed decided to keep rates unchanged, citing uncertainty about the impact of tariffs on the economy. Officials adopted a patience approach due to increased risks of high inflation and unemployment, fueled by the potential impact of tariffs.

Policymakers acknowledged some stagflation risks as they noted the “Committee might face difficult tradeoffs if inflation proves to be more persistent while the outlooks for growth and employment weaken.”

Therefore, the Fed has taken a cautious approach regarding monetary policy, waiting for the “net economic effects of the array of changes to government policies to become clearer.” It is worth noting that the Fed meeting took place before Trump reduced tariffs on China from 145% to 30%.

Bullion’s rally appears to have stalled during the week, as US Treasury bond yields recovered some of the previous week’s fall, underpinning the US Dollar. However, a surprise dovish tilt in the minutes, the less likely scenario, could drive XAU/USD prices higher.

On Tuesday, Fox Business News Gasparino, in a post on X, revealed that a framework between the US and India is close to being announced. It should be noted that the US has taken a more flexible approach to trade talks.

Despite this, the Gold upside remains due to increasing geopolitical tensions between Russia and Ukraine, as well as the Middle East conflict involving Israel and Hamas.

Goldman Sachs analysts recommended a higher-than-usual allocation to Gold in long-term portfolios, revealed Reuters. They cite elevated risks to US institutional credibility, pressure on the Fed, and sustained central bank demand.

Ahead in the week, the docket will feature the second estimate for Gross Domestic Product (GDP) in Q1 2025, and the Fed’s preferred inflation gauge, the Core Personal Consumption Expenditures (PCE) Price Index.

Gold daily market movers: Bullion retreats on strong US Dollar and high US yields

- US Treasury bond yields are rising as the 10-year Treasury note yield increases by four and a half basis points (bps) to 4.493%. Meanwhile, US real yields also advance four bps at 2.171%.

- The US Dollar Index (DXY), which tracks the buck’s value against a basket of six currencies, rises over 0.33% to 99.89, fueled by an improvement in Consumer Confidence data, which grew the most in four years, revealed the Conference Board .

- New York Fed President John Williams said that inflation expectations are well-anchored and added that he wants to avoid inflation becoming highly persistent, as that could become permanent.

- Data revealed that Gold imports to Switzerland from the US rose to its highest level since at least 2012 in April.

- Besides this, Reuters revealed that “China's net gold imports via Hong Kong more than doubled in April from March, and were the highest since March 2024, data showed.”

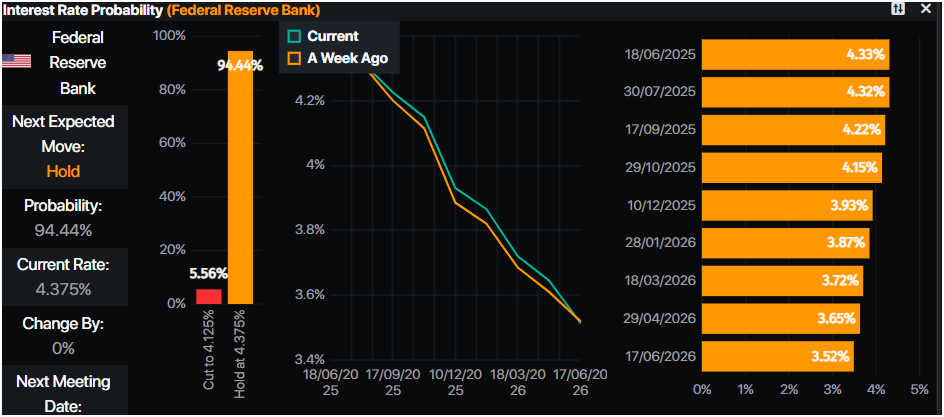

- Money markets suggest that traders are pricing in 45 basis points of easing toward the end of the year, according to Prime Market Terminal data.

Source: Prime Market Terminal

XAU/USD technical outlook: Gold price pullback to challenge $3,250

Gold prices have consolidated within the $3,280-$3,330 range over the last four trading sessions, as bullish momentum appears to be fading due to technical reasons. Momentum, as measured by the Relative Strength Index (RSI), is aiming toward its 50-neutral line, which if broken, could sponsor a leg-lower in XAU/USD prices.

For a continuation of the uptrend, bulls must clear $3,300, $3,400 and the May 7 swing high of $3,438. If achieved, Gold’s next goal would be $3,500.

On the downside, Gold tumbling below $3,250 could expose a move to the 50-day Simple Moving Average (SMA) at $3,211, followed by the May 20 daily low of $3,204.

Fed FAQs

Monetary policy in the US is shaped by the Federal Reserve (Fed). The Fed has two mandates: to achieve price stability and foster full employment. Its primary tool to achieve these goals is by adjusting interest rates. When prices are rising too quickly and inflation is above the Fed’s 2% target, it raises interest rates, increasing borrowing costs throughout the economy. This results in a stronger US Dollar (USD) as it makes the US a more attractive place for international investors to park their money. When inflation falls below 2% or the Unemployment Rate is too high, the Fed may lower interest rates to encourage borrowing, which weighs on the Greenback.

The Federal Reserve (Fed) holds eight policy meetings a year, where the Federal Open Market Committee (FOMC) assesses economic conditions and makes monetary policy decisions. The FOMC is attended by twelve Fed officials – the seven members of the Board of Governors, the president of the Federal Reserve Bank of New York, and four of the remaining eleven regional Reserve Bank presidents, who serve one-year terms on a rotating basis.

In extreme situations, the Federal Reserve may resort to a policy named Quantitative Easing (QE). QE is the process by which the Fed substantially increases the flow of credit in a stuck financial system. It is a non-standard policy measure used during crises or when inflation is extremely low. It was the Fed’s weapon of choice during the Great Financial Crisis in 2008. It involves the Fed printing more Dollars and using them to buy high grade bonds from financial institutions. QE usually weakens the US Dollar.

Quantitative tightening (QT) is the reverse process of QE, whereby the Federal Reserve stops buying bonds from financial institutions and does not reinvest the principal from the bonds it holds maturing, to purchase new bonds. It is usually positive for the value of the US Dollar.