GBP/JPY Price Analysis: Strikes YTD high, but potential intervention by Japanese authorities loom

- GBP/JPY pair notched up a new year-to-date high at 184.77, reflecting Sterling’s strength amidst the Yen’s persistent weakness.

- Eyes on the BoJ for a potential intervention that could weigh on the GBP/JPY pair.

- GBP/JPY immediate support lies at 184.00, while resistance levels emerge at 185.

The GBP/JPY extended its uptrend to seven straight days and printed a new year-to-date (YTD) high at 184.77 amid a mixed market sentiment and a soft Japanese Yen (JPY). The GBP/JPY trades at 184.62 as the Asian session begins, printing minuscule gains of 0.03%.

GBP/JPY Price Analysis: Technical outlook

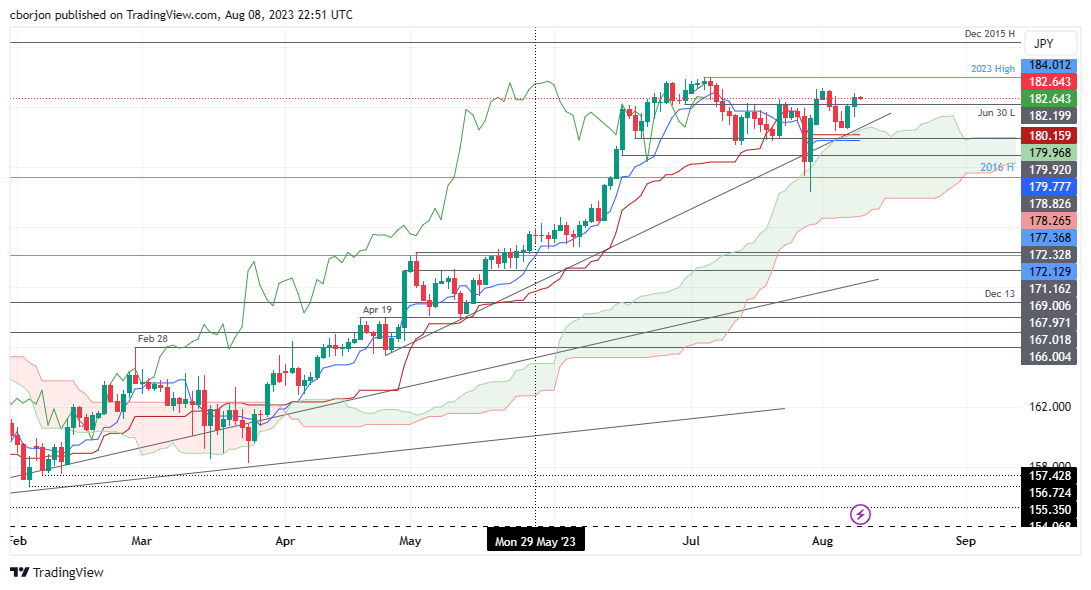

The GBP/JPY is upward biased though it’s at the brisk of a possible intervention by the Bank of Japan (BoJ) or the Japanese Finance Ministry. Japanese authorities could pull the trigger if the Yen continues to post losses against the US Dollar (USD). Still, unless authorities intervene, the GBP/JPY could test the 185.00 figure, followed by the December 2015 high of 186.34.

Conversely, the GBP/JPY first support level would be 184.00. Once cleared, the GBP/JPY could aim toward the August 1 high turned support at 183.25, followed by the Tenkan-Sen at 182.58.

GBP/JPY Price Action – Daily chart