AUD/JPY Price Analysis: Plunges below the Ichimoku cloud, up next 93.00

- AUD/JPY's decline was influenced by China's deepening property crisis and potential central bank tightening.

- Australian Dollar dampened by rising unemployment, signaling RBA may maintain current rates.

- Technical indicators suggest bearish momentum, with key support levels identified at 93.21, 92.89, and 91.78.

AUD/JPY drops in early trading in the Asian session, following Thursday’s 0.66% fall, spurred by risk-aversion amid a deep property crisis in China and speculations that central banks would keep tightening monetary conditions. Consequently, the risk-sensitive AUD/JPY pair edged down and traded at 93.34, losing 0.03%.

Another factor that underwhelmed the Australian Dollar (AUD) was a soft jobs report, with unemployment rising, a signal the labor market is cooling. This means the Reserve Bank of Australia (RBA) would keep rates unchanged towards the next monetary policy decision.

AUD/JPY Price Analysis: Technical outlook

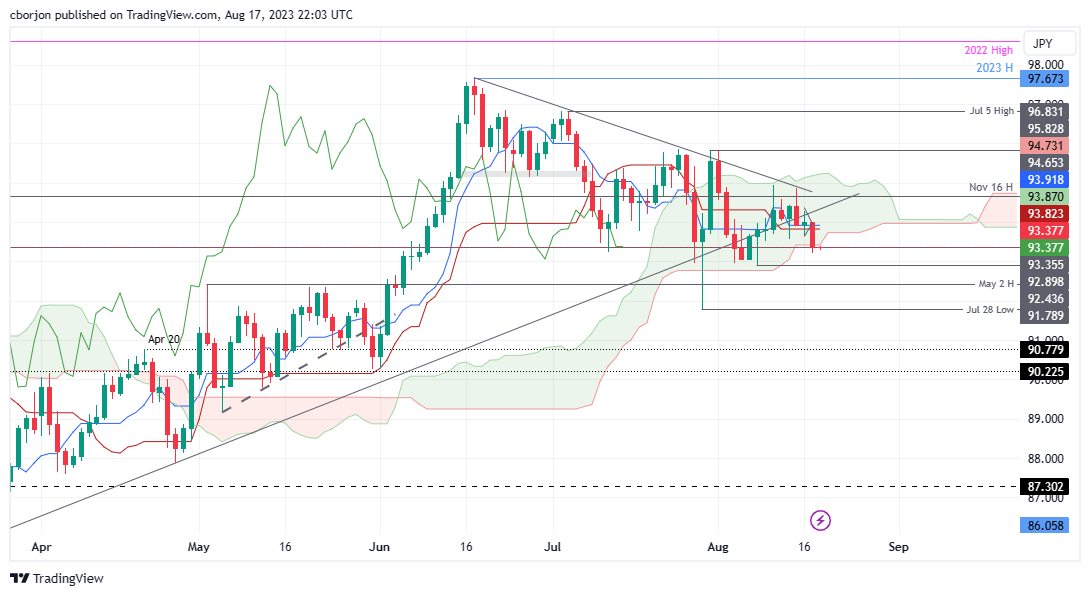

The bias turned bearish with the daily chart showing the pair falling below the Ichimoku Cloud (Kumo). In addition, the Tenkan-Sen crossed below the Kijun-Sen, while the Chikou Span sits below the price action.

Given the backdrop, the AUD/JPY’s path of least resistance is downwards, and first support emerges at the August 17 daily low of 93.21. A breach of the latter will expose the August 8 swing low of 92.89, followed by the July 20 swing low of 91.78. Once those intermediate support levels are cleared, buyers’ next line of defense is the May 31 daily low of 90.26.

AUD/JPY Price Action – Daily chart