USD/CAD stalled after a four-day rally, spurred by risk-aversion on China’s economic woes

- USD/CAD advances 0.05% to 1.3551, buoyed by investor concerns over China’s shadow bank and real estate crises.

- US retail sales exceed expectations, supporting the Fed’s stance on maintaining restrictive monetary policy.

- Canadian July Producer Prices rebound with a 0.4% rise, driven by surges in oil and lumber prices.

USD/CAD prepares to finish the week on a higher note, with gains of 0.84%, extending its rally to five straight days but remains unable to claim the 1.3600 figure. Risk aversion continues to take its toll on global equities, sparking flows to safe-haven assets. Hence, the USD/CAD is almost flat, exchanging hands at 1.3545.

Evergrande’s bankruptcy and China’s economic downturn bolster the greenback, while Canadian Producer Prices show recovery

The pair extended its gains on risk aversion, as investors weighed China’s economic woes. Recent data revealed the second-largest economy is deteriorating. At the same time, the shadow bank crisis and real estate turmoil escalated after Thursday’s news that Evergrande filed for Chapter 15 bankruptcy in New York.

The US economic docket was light, but recent data showed that retail sales pushing above estimates and a robust labor market justifies the Federal Reserve’s (Fed) need to keep monetary policy at restrictive levels. The latest monetary policy meeting minutes emphasized the Fed’s commitment to bring inflation towards its 2% target, though some officials began to be cautious about upcoming meetings.

In the meantime, the Canadian economic calendar revealed that July Producer Prices rose by 0.4%, exceeding June’s -0.6% plunge, underpinned by oil and lumber prices. Raw materials prices rose 3.5% in July but remained down 11.1% in the year.

The USD/CAD remained on the front foot, but a late uptick in oil prices shifted the USD/CAD negative. The US Dollar Index (DXY), a gauge of the greenback’s value against a basket of six currencies, hovered around two-month highs but retraced to 103.389, almost flat. The US Treasury bond yields pare some of its losses, with the US 10-year Treasury note yielding 4.239%, down four bps.

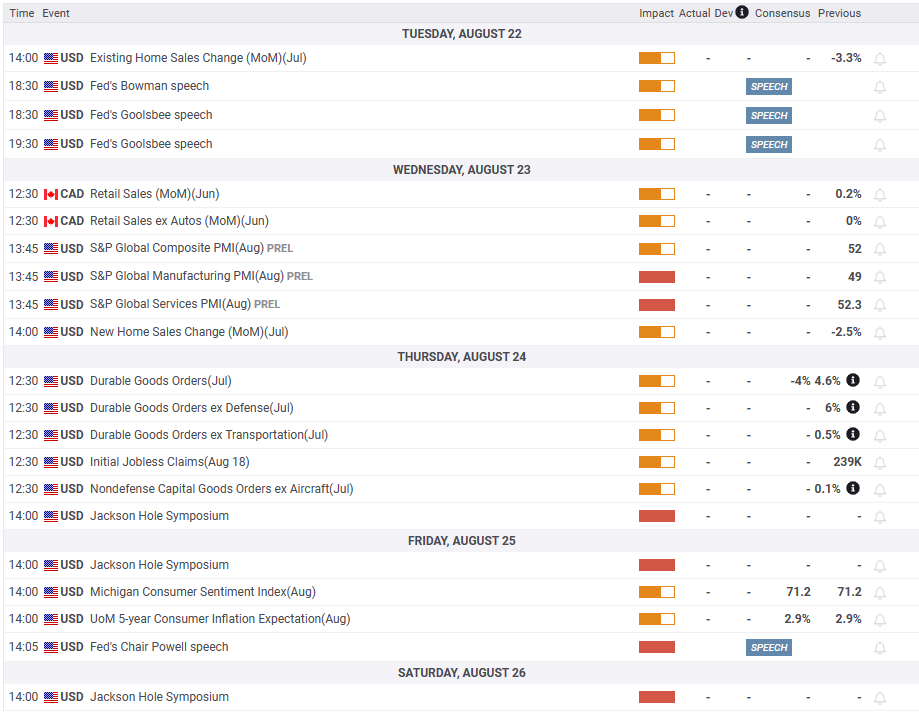

What to watch?

USD/CAD Price Analysis: Technical outlook

The USD/CAD bias remains upward as price action cleared the 200-day Moving Average (DMA) at 1.3451, though it faltered to clear the May 30 daily low turned resistance at 1.3567, which once reclaimed, as the USD/CAD pair would rally towards the May 26 swing high at 1.3654. If that level is cleared, the year-to-date (YTD) high would be up for grabs at 1.3862.