AUD/JPY Price Analysis: Struggles at Tenkan-Sen line, collapses on soft Aussie CPI

- AUD/JPY kicks off the Asian session with a retreat, trading at 95.30, down 0.05% amid RBA rate hike speculations and disappointing CPI results.

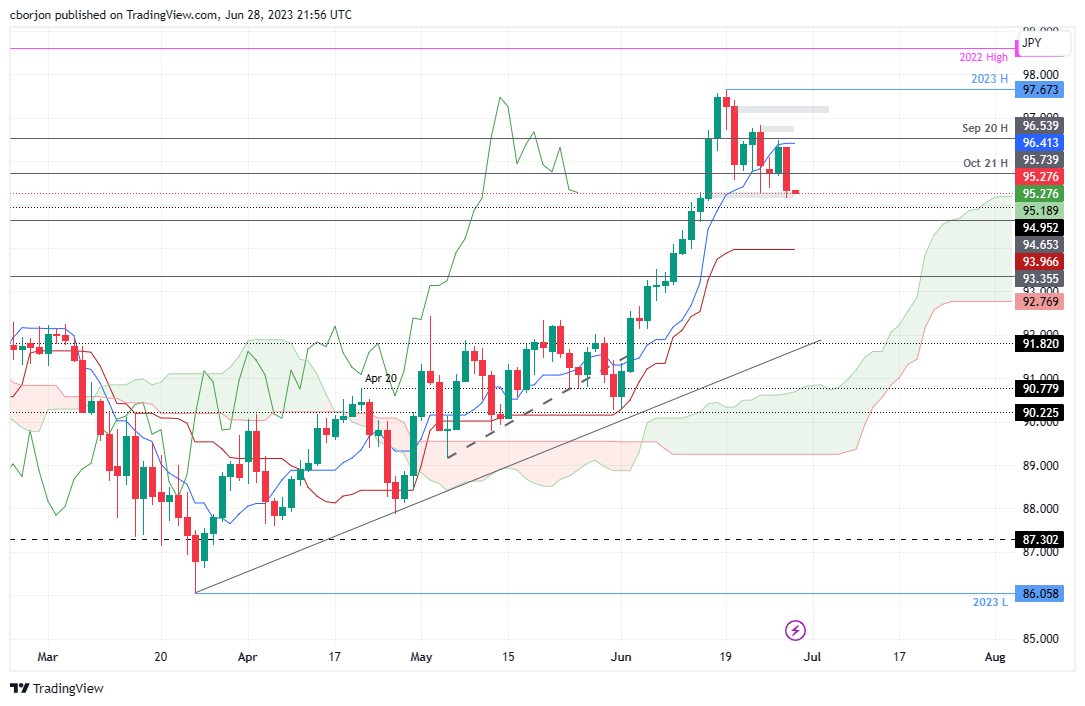

- AUD/JPY plummets after failing to breach the Tenkan-Sen line at 96.41, hitting a two-week low of 95.15 but remaining above the Ichimoku Cloud, upholding the uptrend.

- Further falls may lead AUD/JPY to the Kijun-Sen line at 93.96 or the previous year’s daily high at 93.35.

The AUD/JPY retreats as the Asian session begins after registering huge losses of 1% on Wednesday, courtesy of speculations the Reserve Bank of Australia (RBA) would not raise rates as the Consumer Price Index (CPI) was below estimates. Therefore, the AUD/JPY is trading at 95.30, down 0.05%.

AUD/JPY Price Analysis: Technical outlook

The AUD/JPY tumbled sharply after failing to pierce the Tenkan-Sen line at 96.41, extending its losses past the 96.00 figure, achieving a two-week low of 95.15. Despite the AUD/JPY pullback, it remains above the Ichimoku Cloud, confirming the uptrend, though about to face support at the Senkou Span A line at 95.18.

A fall below the latter could drag AUD/JPY prices toward the Kijun-Sen line at 93.96, slightly below the 94.00 figure, followed by last year’s December 13 daily high turned support at 93.35.

Conversely, if AUD/JPY buyers reclaim the 96.00 psychological level, that could open the door to recapturing the Tenkan-Sen resistance level at 96.41. Once cleared, the next resistance would be the 97.00 mark before testing the year-to-date (YTD) high of 97.67.

AUD/JPY Price Action – Daily chart