GBP/JPY Price Analysis: Bulls ready to test 186.00 in the short term

- GBP/JPY pair trades nearly flat at 185.58 as risk aversion strengthens the USD/JPY pair, indirectly softening the Yen against most G8 currencies.

- Technical analysis shows the pair with an upward bias, facing next resistance at the August 30 high of 186.06 and a year-to-date high at 186.76.

- Short-term hourly chart suggests a sideways but slightly upward tilt, with crucial support and resistance levels identified at 185.17 and 186.19, respectively.

The Pound Sterling (GBP) gained ground against the Japanese Yen (JPY) amid risk aversion, which triggered flows toward the safe-haven status of the Greenback (USD). Hence, strength in the USD/JPY pair weighed on the JPY, which remained soft against most G8 currencies. The GBP/JPY exchanges hands at 185.58, almost flat as the Asian session begins.

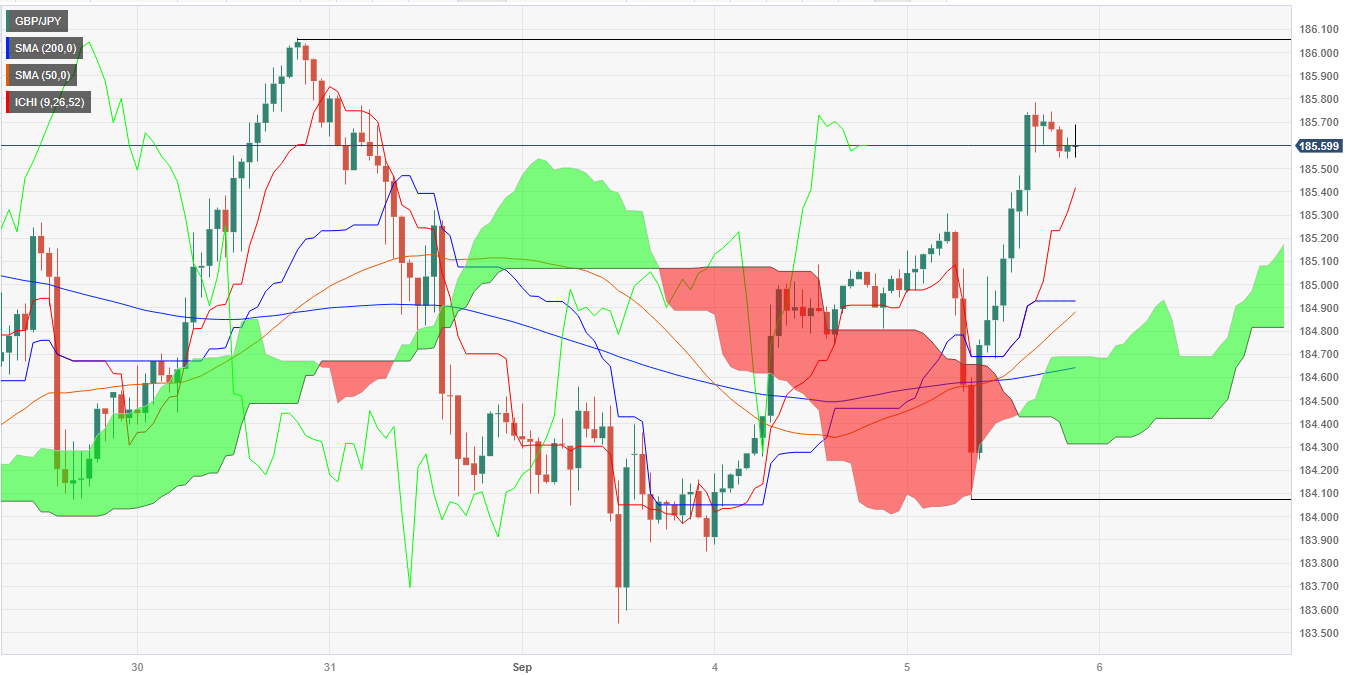

GBP/JPY Price Analysis: Technical outlook

The daily chart portrays the pair as upward biased, though it still needs to clear the next resistance seen at the August 30 high at 186.06. An upside break would expose the year-to-date (YTD) high of 186.76 before the GBP/JPY tests 187.00. Conversely, downside risks emerge at the Tenkan-Sen line at 184.70, followed by the Senkou Span at 184.14. Once that area is cleared, the pair’s next stop would be the Kijun-Sen line at 183.58.

In the short term, the GBP/JPY hourly chart portrays the pair as sideways, though slightly tilted upwards. If the pair breaks the August 30 high of 186.06, the R1 daily pivot would be the next resistance at 186.19. A breach of the latter would expose the YTD high at 186.76, shy of the R2 pivot point at 186.84. On the downside, the first support would be the confluence of the daily pivot and the Senkou Span A at 185.17, followed by the psychological 185.00 figure.

GBP/JPY Price Action – Hourly chart