GBP/JPY knocking into thin topside on Monday, churning just south of 128.00

- The GBP/JPY saw thin trading on Monday, heading into Tuesday testing the upper bounds just below 182.00.

- The Pound Sterling continues to sag against the Yen in the short-term, down over 2.5% from August's peak.

- The long term remains notably bullish, and the GBP/JPY is still up almost 18% for 2023.

The GBP/JPY spread the middle for Monday, with neither the Pound Sterling (GBP) nor the Yen (JPY) finding momentum to get the chart kickstarted for the new trading week.

The GBP has struggled to find support on the charts after the Bank of England (BoE) held rates steady last week in a split vote, and it appears the end of the rate hike cycle for the UK has landed much sooner than many analysts expected. With the UK's domestic economy teetering in the fundamental data, the BoE is hoping interest rates are high enough to keep inflation capped moving forward.

On the JPY side, the Bank of Japan (BoJ) Governor Kazuo Ueda and Deputy Governor Shinichi Uchida hit news wires on Monday. The BoJ officials talked down any hawkish expectations, reiterating the BoJ policy stance that inflation is at risk of dipping below 2%, the Japanese central bank's minimum target before a reversal of the BoJ's negative rate regime can be considered.

Read more:

BoJ’s Ueda: Stable, sustainable achievement of 2% inflation not yet in sight

BoJ’s Uchida: Central bank needs to patiently continue monetary easing

BoJ’s Ueda: Our basic stance is that we must patiently maintain monetary easing

Economic calendar looking light on the data docket until Thursday

The early week sees little of note for the GBP/JPY on the economic calendar, and traders will be looking towards Thursday's Tokyo inflation reading and Friday's Gross Domestic Product (GDP) figures for the UK.

Japan's Tokyo Consumer Price Index (CPI) reading is slated for 23:30 GMT late Thursday, and the core annualized figure is forecast to tick lower from 2.8% to 2.6%.

On the UK side, GDP numbers are forecast to hold steady, with the annualized GDP growth rate for the second quarter expected to print at 0.4%, in-line with the previous reading.

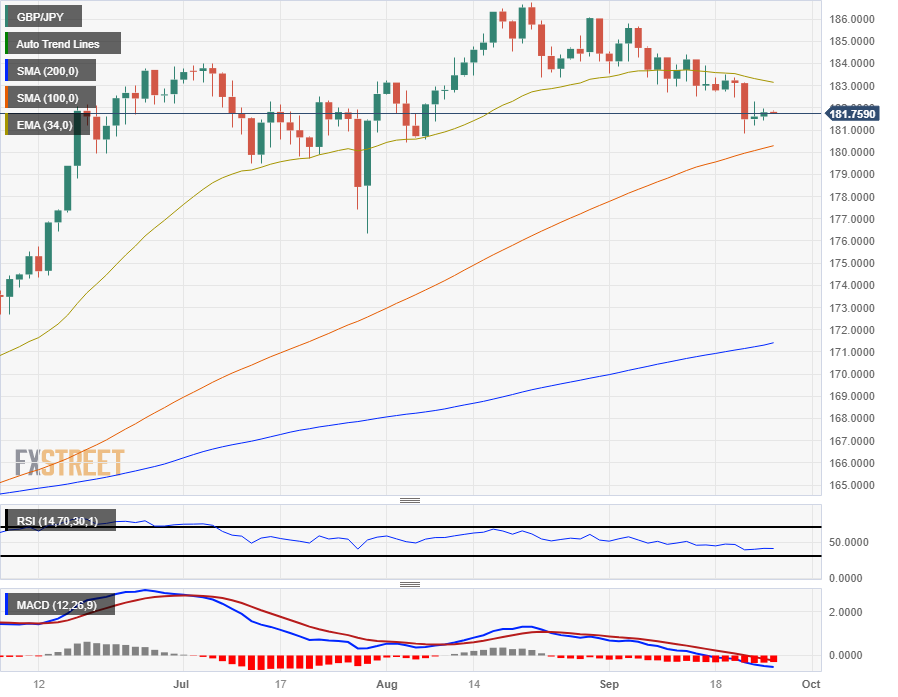

GBP/JPY technical outlook

Intraday action has the GBP/JPY hamstrung just below the 182.00 major handle, and the pair is set to build in a floor from 181.00 as bidders look for a re-challenge of the 200-hour Simple Moving Average (SMA) settling into 182.70.

Daily candlesticks see the Guppy settling back into the 100-day SMA, with the long-term bull trend leaving the GBP/JPY well above the 200-day SMA near 172.00. The pair has slipped below the 34-day Exponential Moving Average (EMA) in the near-term, and buyers will need to remount the 186.00 handle from August's last swing high before establishing a continuation of the bull trend.

GBP/JPY daily chart

GBP/JPY technical levels